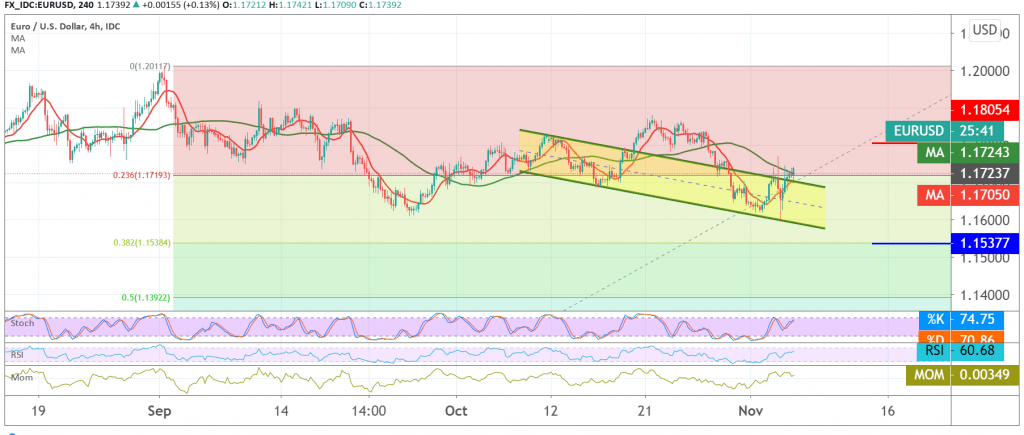

The single currency continues to fluctuate in the same price range without any change, the current moves are witnessing attempts to recover and consolidate above 1.1720 resistance.

Technically, looking at the 4-hour chart, we find that the stochastic is still trading in negative areas and favoring the return of the bearish bias. This contradicts the positive stimulus coming from the 50-day moving average that started to carry the price.

With the conflict of technical signals, we will remain neutral for the time being until the next trend comes to light, so we will be facing one of the following scenarios:

The bullish bias depends on confirming the breach of the 1.1770 resistance level to enhance the chances of a bullish move towards 1.1800 and then 1.1870, and the gains may extend to 1.1920.

Activating short positions needs to witness a clear and strong break of the 1.1620, and from here the official bearish trend begins to dominate the pair’s movements, opening the way to 1.1540 Fibonacci retracement of 38.20%.

Warning: the level risk is high and not commensurate with the expected return in light of uncertainty about the US election results.

| S1: 1.1635 | R1: 1.1800 |

| S2: 1.1535 | R2: 1.1870 |

| S3: 1.1470 | R3: 1.1970 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations