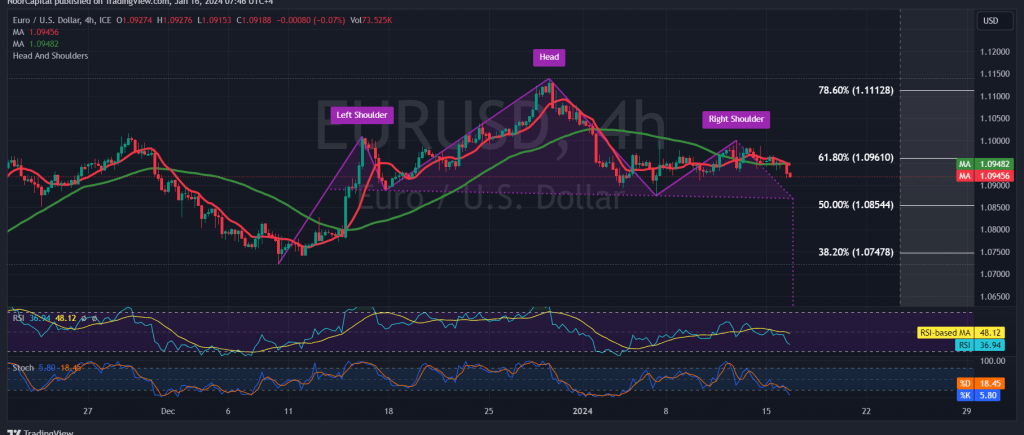

The EUR/USD pair initiated the week with a decline, encountering significant resistance around 1.0960 that prompted a negative trajectory. Presently, the pair is stabilizing near 1.0915.

From a technical perspective today, examining the 4-hour timeframe chart reveals persistent pressure on the price from the simple moving averages from above. Additionally, the pair remains below a pivotal resistance level situated at 1.0960, marked by the 61.80% Fibonacci retracement.

Given these conditions, a preference for a downward trend is apparent in today’s trading. A break below 1.0900 makes the task of reaching 1.0860, an official station around the 50.0% Fibonacci retracement, more likely. Breaking this level would further strengthen the daily downward trend, with subsequent targets at 1.0800 and 1.0770.

It’s crucial to note that consolidation above 1.0960, confirmed by at least an hourly candle close, would defer the possibility of a decline. In such a scenario, positive attempts may be witnessed, targeting a retest of 1.1000.

Caution is advised as high-impact economic data is anticipated today, including the “New York State Manufacturing Index” from the American economy, Canadian inflation data, and key updates from the United Kingdom, such as “the change in unemployment benefits” and a speech from the Governor of the Bank of England. Expect heightened price volatility during the release of these news items.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations