Quiet trading dominated the movements of the EURUSD at the beginning of this week amid the absence of economic indicators, in addition to the holiday in the US markets yesterday, which led to a decline in trading volumes.

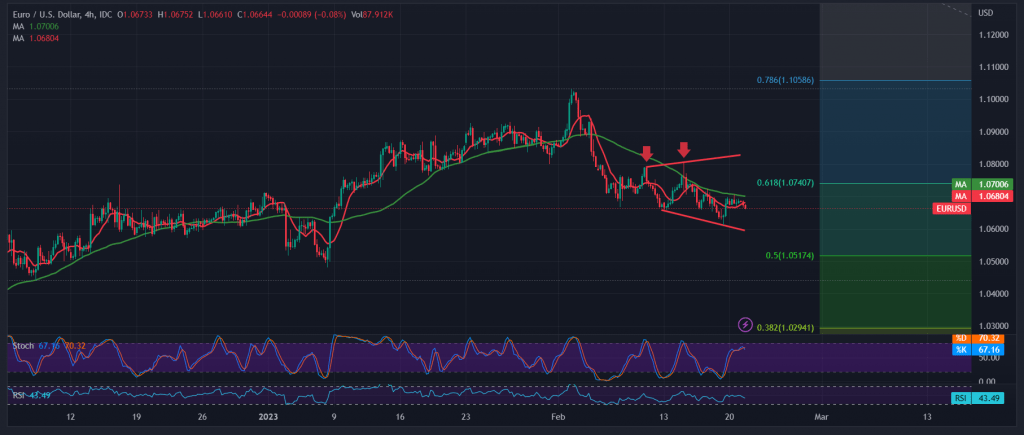

Technically, today, the EUR/USD pair started trading on a negative note and failed to settle for a long time above the resistance level of the psychological barrier of 1.0700. Looking closely at the 240-minute chart, we find that the simple moving averages continue to exert negative pressure on the price from above, stimulated by the clear negative signals on the indicator. Stochastic.

Therefore, the bearish scenario may be the most likely during today’s trading session, targeting 1.0630 as a first target, knowing that price stability below the mentioned level increases and accelerates the strength of the bearish trend, to be waiting for touching 1.0570 and the current downside wave may extend towards 1.0515, Fibonacci correction 50.0%.

Activating the expected downside track above requires trading to remain below 1.0700, we expect the continuation of the decline as long as the pair is generally stable below 1.0745, the pivotal resistance represented by the 61.80% correction.

Note: Today we are awaiting high-impact economic data issued by the US economy “Services PMI”, and we may witness high volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations