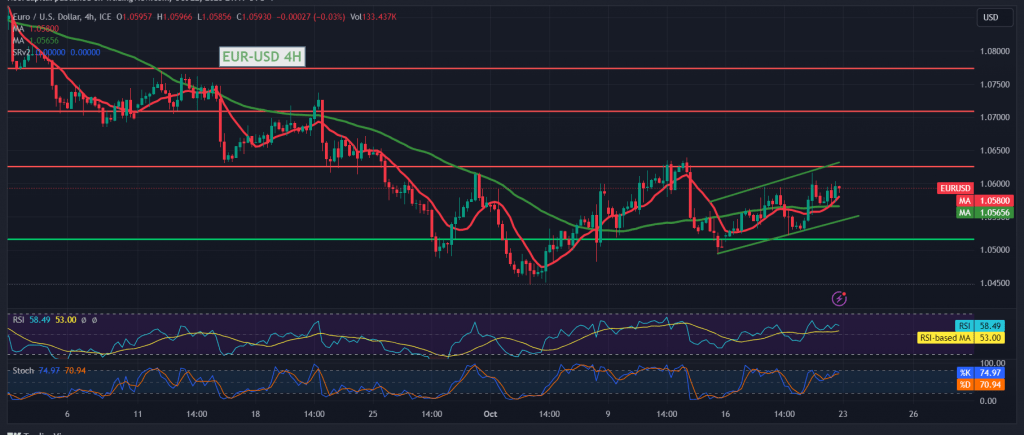

We remained neutral during the last report, explaining that we are waiting for the pair to break free from the sideways price range confined between 1.0500 and 1.0600. The EUR/USD pair concluded last week’s trading on a positive note and began attacking the resistance of the psychological barrier 1.0600, recording the highest level of 1.0616.

Technically, and with a closer look at the 240-minute time frame chart, we find the 50-day simple moving average holding the price from below, supporting the upward daily price curve, in conjunction with the positive signals from the 14-day momentum indicator.

From here, with the stability of intraday trading above 1.0540 and in general above 1.0500, an upward bias is most likely during today’s session, provided that we witness the price consolidation above 1.0600. A first target is 1.0640/1.0630, and breaching it enhances the chances of touching 1.0670, an awaited next station.

Closing at least an hour candle below 1.0540 will postpone the chances of a rise. We may witness a retest of 1.0500, considering that the pair’s decline below 1.0490 will immediately stop any attempts to rise, and the pair is preparing to visit 1.0450 and 1.0430.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations