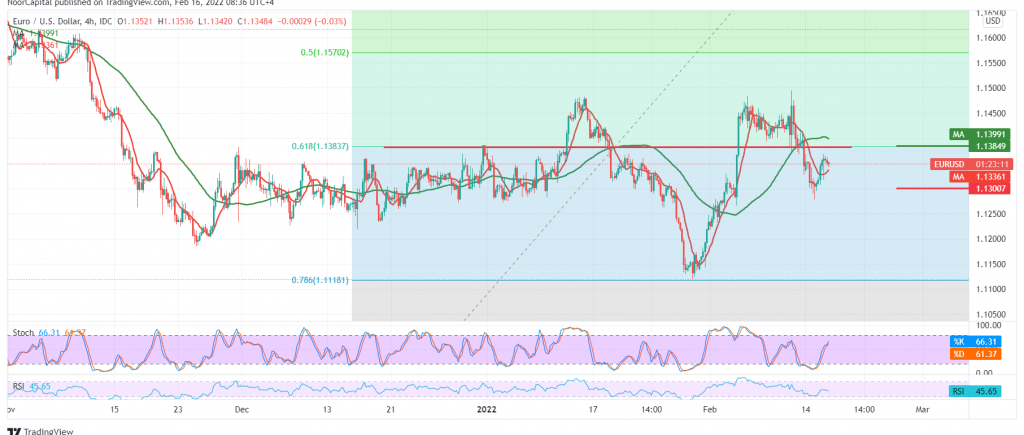

The movements of the Euro against the US dollar witnessed a mixed session, approaching by a few points from the first official station targeted in the previous analysis at 1.1510, posting the highest level of 1.1495, to trade again on the negative side as approaching the resistance level of the psychological barrier 1.1500, which forced it to retest the support floor 1.1380.

On the technical side, today, the current movements are witnessing stability around the lowest level during the early trading of the current session at 1.1380. The Euro starts pressing on the mentioned support level, which is the key to protecting the bullish bias. With a closer look at the 240-minute chart, we notice the loss of the bullish momentum stochastic, in addition to the clear negative signs on the 14-day momentum indicator.

We need to witness a clear break of the 1.1380 support level represented by the 61.80% Fibonacci correction as shown on the chart, because this may lead the Euro to visit 1.1340 and 1.1300 respectively, and initial stations may extend later to visit 1.1265 as long as the price is stable below the 1.1470 pivotal supply area.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1305 | R1: 1.1380 |

| S2: 1.1265 | R2: 1.1410 |

| S3: 1.1210 | R3: 1.1470 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations