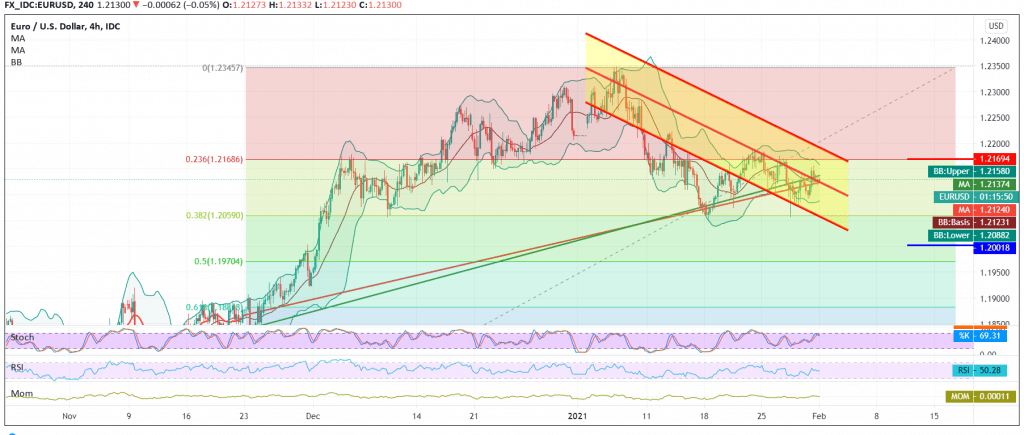

Narrow range sideways trades dominate the movements of the euro against the US dollar, capped from the bottom above the minor support level of 1.2100 and from the top below the resistance level at 1.2170.

Technically, and with a closer look at the 240-minute chart, we find the pair is stable below the resistance level of the descending corrective channel located at 1.2170 represented by the 23.60% Fibonacci retracement, we also find negative signs are still clear on the stochastic indicator.

Thus, the bearish scenario will remain valid and effective, knowing that trading below 1.2100 facilitates the task required to visit the first official target 1.2065, retracing 38.20%, and then 1.2000 following official stations.

A reminder that activating the bearish scenario depends on trading remaining below the aforementioned resistance, and surpassing it upwards will immediately stop the bearish scenario and lead the pair to an upward corrective path, with the initial target is to re-test 1.2220 / 1.2230.

| S1: 1.2095 | R1: 1.2170 |

| S2: 1.2065 | R2: 1.2220 |

| S3: 1.2010 | R3: 1.2265 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations