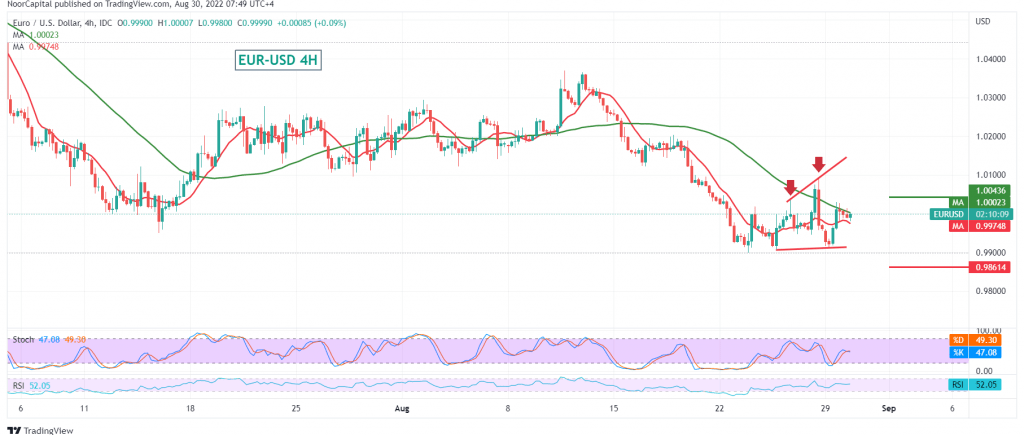

The euro’s attempts to compensate for its losses against the US dollar during the previous trading session failed to find a strong resistance level of 1.0040 that successfully limited the bullish bias. As we explained in the previous report, the above-mentioned level is a prerequisite for recovery.

Technically, today, the euro is still stable below 1.0040 resistance, as we find the 50-day simple moving average that is a negative pressure factor on the price, coinciding with the limited bullish momentum on the short time frames.

Therefore, the bearish scenario is the most preferred, targeting 0.9960 and 0.9930, respectively. It should be noted that breaking the latter enhances the chances of resuming the bearish trend, paving the way for the euro to visit 0.9865 next station.

We remind you that activating the above-suggested scenario requires trading stability below 1.0045, and penetrating it may lead the pair to enter into a minor bearish correction, with its initial target of 1.0100.

Note: The US “Consumer Confidence” index is scheduled to be released later in today’s session, and it has an important impact and we may witness price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9930 | R1: 1.0045 |

| S2: 0.9865 | R2: 1.0100 |

| S3: 0.9810 | R3: 1.0160 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations