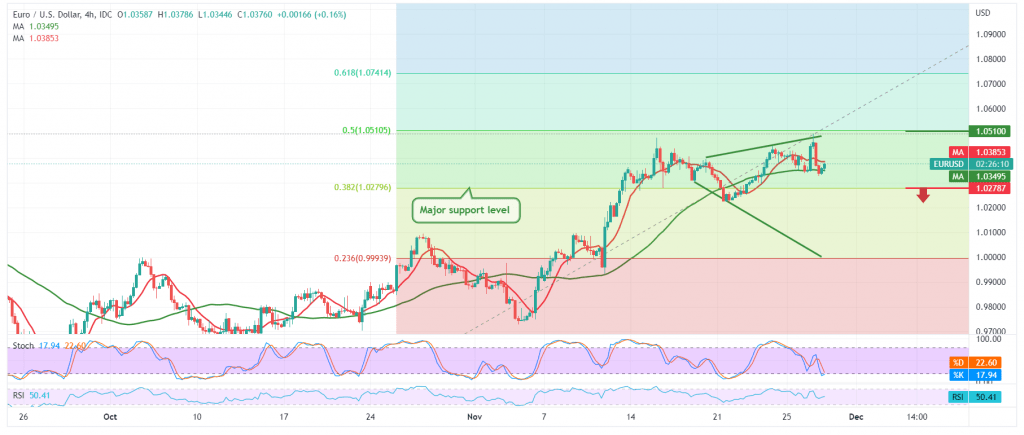

Mixed trading dominated the movements of the euro-dollar pair during the previous trading session, recording its highest level at 1.0497, after it managed to consolidate temporarily above the resistance level published during the previous analysis 1.0420, to return to decline quickly as a result of approaching the resistance level of the psychological barrier 1.0500, to test the support floor at 1.0330.

On the technical side today, by looking at the 240-minute chart, we find the 50-day simple moving average that continues to hold the price from below. In addition, we notice the return of the positive signs of the momentum indicator.

With the pair maintaining positive stability above the strong demand area 1.0280, represented by the 38.20% Fibonacci correction, that encourages us to maintain our positive expectations, targeting 1.0440 and 1.0465 as initial targets, taking into consideration that the upward breach and consolidation above it opens the door to visit the official station 1.0520.

The decline below 1.0280 can completely thwart the bullish scenario, and we are witnessing a negative trading session for the Eurodollar pair, targeting 1.0230. The losses may extend later towards 1.0170 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0280 | R1: 1.0465 |

| S2: 1.0230 | R2: 1.0520 |

| S3: 1.0130 | R3: 1.0565 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations