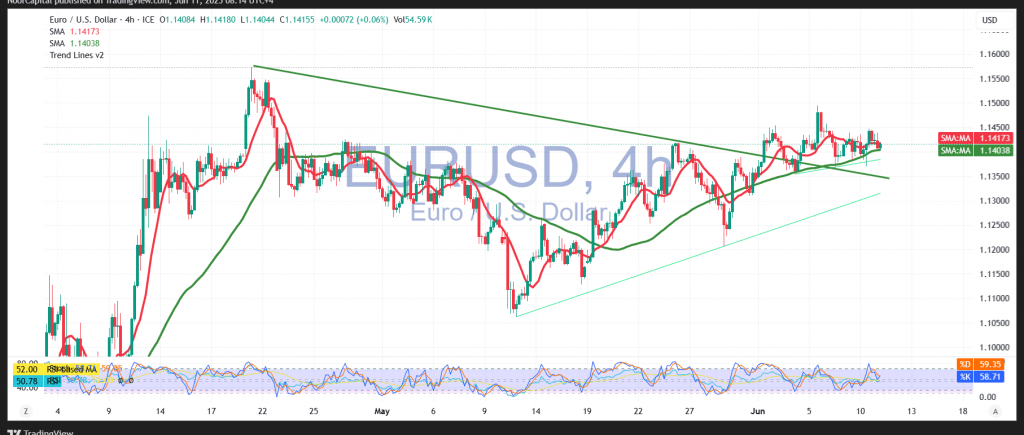

Mixed trading with a bearish tilt characterized the EUR/USD pair’s movement in the previous session, following its failure to hold above the extended resistance zone of 1.1450/1.1440. This hesitation at key resistance reflects temporary exhaustion after the recent bullish run.

From a technical standpoint, the Relative Strength Index (RSI) is beginning to ease from overbought conditions on the short-term charts, signaling potential for a short-lived pullback or consolidation. However, the 50-day simple moving average (SMA) continues to act as dynamic support, reinforcing the broader uptrend. Additionally, price action remains aligned with an ascending trendline, suggesting that the bullish structure remains intact.

As long as intraday trading holds above 1.1350—and more importantly, 1.1340—the upward bias remains valid. A sustained move above the 1.1400 level would act as a bullish trigger, increasing the likelihood of reaching the next resistance zone at 1.1470/1.1480, with potential for gains to extend toward 1.1520.

Conversely, a break and daily close below 1.1340 would weaken the bullish outlook and postpone the upside scenario, opening the door for a possible retest of the 1.1275 level before any renewed bullish momentum.

Warning: Today’s release of the U.S. Core Consumer Price Index (CPI)—both monthly and annual—carries significant market-moving potential. Expect heightened volatility around the data release.

Caution: The current market environment remains sensitive to macroeconomic developments and geopolitical tensions. All scenarios remain on the table.

Risk Disclaimer:

With ongoing global trade tensions and key economic data in focus, risk levels remain elevated. Traders should remain vigilant and prepare for potential sharp price swings in either direction.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations