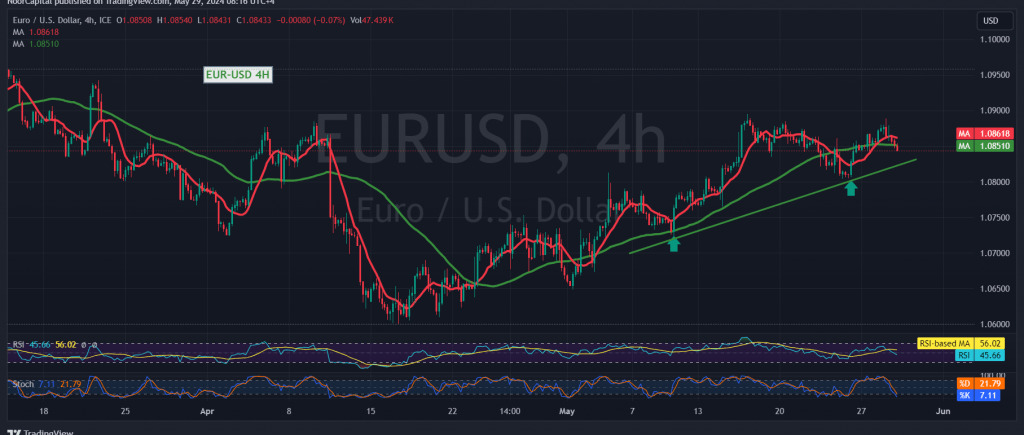

The euro is experiencing a critical moment in its ongoing dance with the U.S. dollar. After a brief flirtation with the 1.0900 resistance level, the pair has retreated to 1.0845, leaving traders pondering its next move.

A closer look at the technical landscape reveals a delicate balance between bullish and bearish forces. On one hand, the 50-day simple moving average is applying downward pressure, suggesting a potential continuation of the recent decline. However, the stochastic oscillator is nearing oversold territory, indicating that the selling pressure might be waning. Additionally, the pair remains supported by the 1.0815/1.0820 level, a key zone that has repeatedly defended the euro in recent weeks.

The fate of the euro now hinges on the outcome of this tug-of-war. A decisive break below 1.0810 could trigger a wave of selling, pushing the pair towards the 1.0795 support level. If this level fails to hold, the euro could face further downside pressure, potentially reaching 1.0735.

Conversely, a rebound from current levels and a confirmed break above 1.0880 would signal a resumption of the bullish trend, with the next target being 1.0970.

Market participants are keenly watching these critical levels, as they hold the key to unlocking the euro’s next move. The coming days will be crucial in determining whether the bulls or bears will gain the upper hand in this ongoing battle.

Disclaimer: This article provides a technical analysis of the EUR/USD pair and is not intended as investment advice. Trading involves risks, and traders should conduct their own research and analysis before making any trading decisions.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations