EURUSD reached the first awaited target during the previous analysis, at 1.0580, recording its highest level during the last session trading at 1.0582.

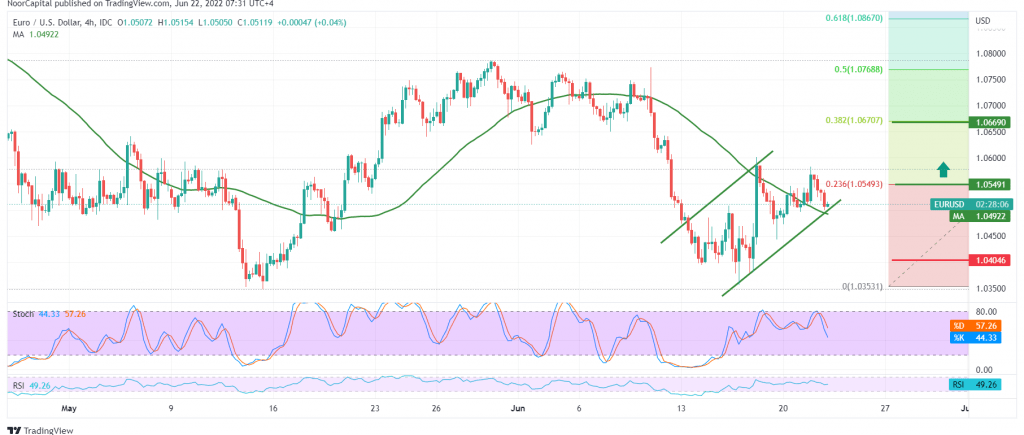

On the technical side, the pair witnessed a bearish tendency as a result of hitting the resistance level represented by the target of 1.0580, which forced the pair to retest the support of the psychological barrier of 1.0500, with careful consideration on the 4-hour chart, we notice the clear negative signs on the momentum indicator. However, the moving average still holds the Price from below.

We tend to be positive unless we witness a clear and strong break of the 1.0470 support level, knowing that the consolidation again above 1.0550, the 23.60% Fibonacci correction, facilitates the task required to visit 1.0580 and 1.0630, respectively, and extend the targets towards 1.0670, 38.20% correction, an official station.

Sneaking below 1.0460 and the Price’s pivot below the mentioned level will stop the aforementioned rise attempts and put the pair under negative pressure again, with an initial target of 1.0400.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0460 | R1: 1.0580 |

| S2: 1.0400 | R2: 1.0630 |

| S3: 1.0350 | R3: 1.0670 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations