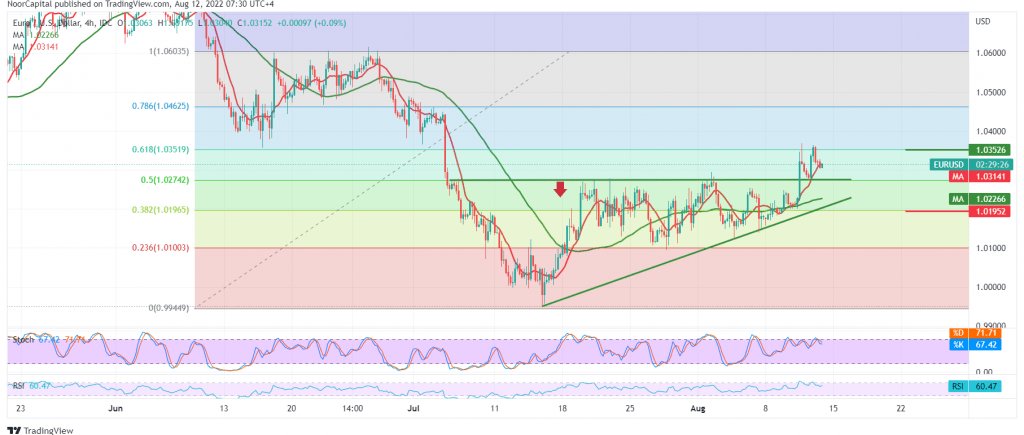

The positive attempts of the euro against the US dollar continue, and the positivity is still limited, to find the pair unable to consolidate above the strong resistance level at 1.0350, which constitutes the key to protecting the bearish trend.

Technically, we are inclined towards a bearish bias in the coming hours, based on the stability of trading below 1.0350, the pivotal resistance represented by the 61.80% Fibonacci correction, in conjunction with the clear negative signs on the stochastic indicator.

Therefore, we may witness a bearish bias, knowing that the breach below the previously breached resistance and turned to the 1.0275 support level, the 50.0% correction, facilitates the task required to retest 1.0200/1.0220.

Remember that any trading above 1.0350 and the price stability above it nullifies the activation of the bearish tendency and increases the chances of the euro touching the 1.0400 and 1.0450 areas for subsequent stations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0275 | R1: 1.0350 |

| S2: 1.0220 | R2: 1.0400 |

| S3: 1.0160 | R3: 1.0400 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations