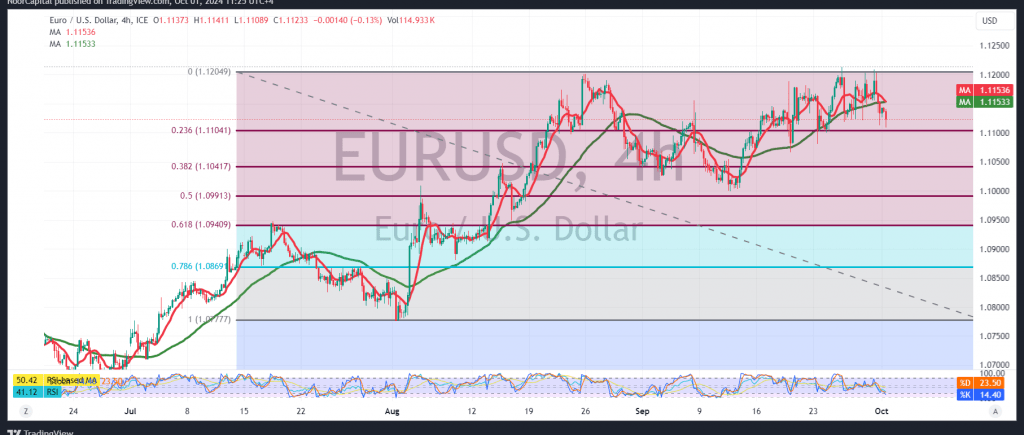

Negative trading dominated the movements of the euro against the US dollar during the first trading session of the current week, with the pair encountering a strong resistance level around the psychological barrier of 1.1200, which resulted in a bearish bias.

On the technical side today, and with a closer look at the 4-hour chart, despite the bearish trend, the Stochastic indicator appears to be attempting to shed momentary negativity, beginning to send positive signals that could be sufficient for a bullish reversal. This comes in conjunction with trading stability above the pivotal support level of 1.1100.

As long as daily trading remains above the strong support level of 1.1100 and the 23.60% Fibonacci correction level, the bullish trend remains valid and effective. Breaking above the 1.1200 resistance level would further strengthen and accelerate this trend, paving the way toward the first target at 1.1250, and subsequently the next anticipated level at 1.1285.

We remind you that a confirmed break below 1.1100, and more importantly 1.1095, would halt the expected bullish scenario and place the pair under negative pressure, aiming to retest 1.1055 and 1.1000, respectively.

Warning: Today, high-impact economic data from the US, specifically the “Job Vacancies and Labor Turnover Rate,” is expected, which could cause high price volatility.

Warning: The risk level remains high amidst ongoing geopolitical tensions, and all scenarios remain possible.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations