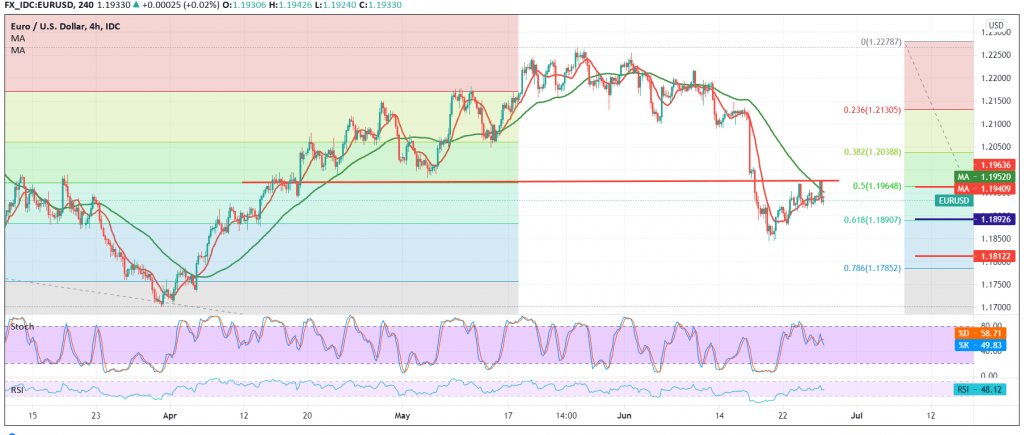

The Euro hit the strong resistance level located at 1.1975, unable to breach it yet, which forced the pair to trade negatively and settle below it.

On the technical side, we tend to the negativity, relying on the stability of trading below 1.1975 located at the 50.0% Fibonacci correction, as shown on the 240-minute chart, in addition to the pair continuing to get pressure from the 50-day moving average.

Therefore, the bearish bias is likely today, targeting 1.1880, 61.80% correction, and we should pay close attention in case the mentioned level is broken, because this extends the continuation of the current descending wave to be 1.1840 and 1.1810, awaited official stations.

From the top, we can skip upwards and rise again above 1.1975, and most importantly 1.1990 is able to thwart the bearish scenario, and we may witness a slight bullish slope targeting 1.2040, and it may extend later to visit 1.2070.

| S1: 1.1880 | R1: 1.1975 |

| S2: 1.1845 | R2: 1.2030 |

| S3: 1.1810 | R3: 1.2070 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations