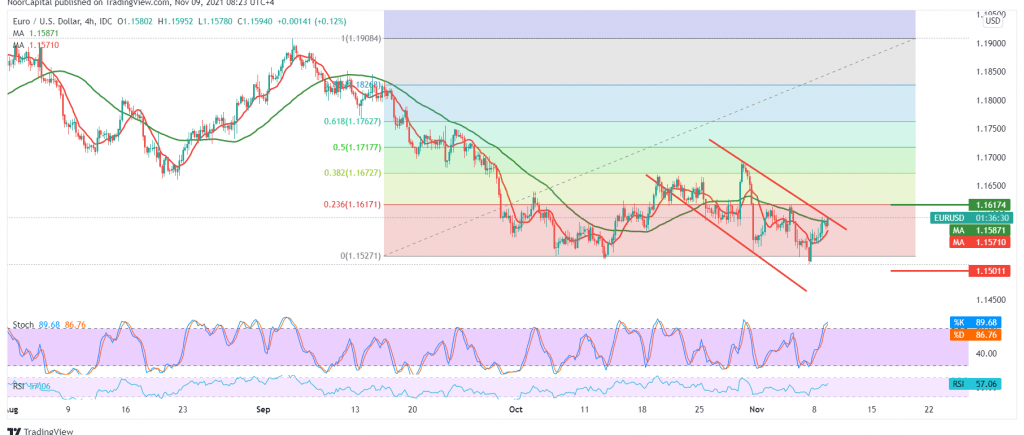

The single European currency started its first weekly trading within a slight bullish slope within attempts to recover. However, it is still limited, building on the 1.1520 support floor, trying to retest 1.1610/1.1600.

Technically, by looking at the chart, we notice the price’s attempts to move above the 50-day moving average, accompanied by the RSI sending signals that support the rise. On the other hand, we find negative crossover signs that started appearing on the stochastic indicator.

We believe that touching the resistance level of 1.1610 represented by the 23.60% Fibonacci correction around the descending trend line constitutes an obstacle preventing the pair’s advancement. Therefore the bearish scenario will remain valid and effective, targeting 1.1550 and breaking it facilitate the task to visit 1.1500 next station.

The price behavior should be carefully monitored around the resistance level of 1.1610 and, most importantly, 1.1640 because a breach of the latter can postpone the expected bearish scenario, and the euro may start moving within a temporary ascending path targeting 1.1690/1.1680.

| S1: 1.1550 | R1: 1.1610 |

| S2: 1.1500 | R2: 1.1640 |

| S3: 1.1440 | R3: 1.1680 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations