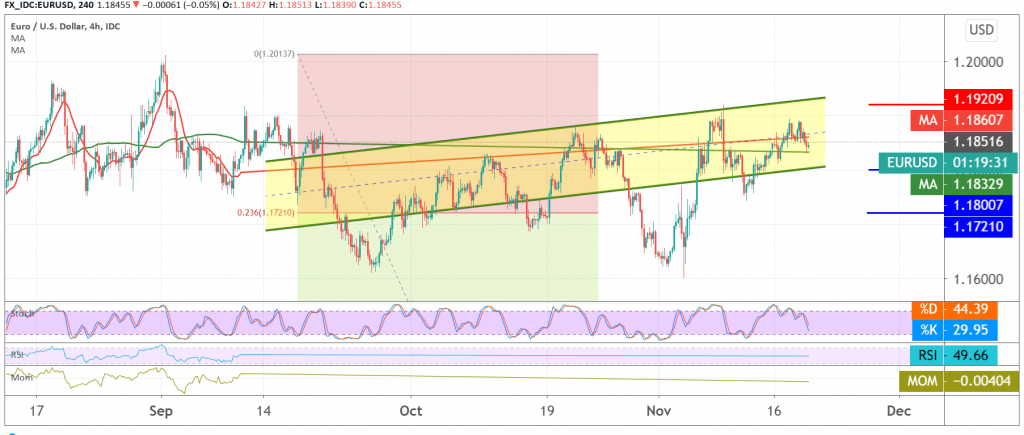

The single European currency continues to move within a positive sideways range, within a gradual rise to the upside, posting a high at 1.1891.

Technically, we find the euro facing hard time in breaching the 1.1880 resistance level and stabilizing above it, and with a closer look at the 4-hour interval chart, we find negative signs still dominating the pair’s movements, accompanied by the negative pressure of the simple moving averages over short intervals.

Therefore, we believe that there is a possibility of witnessing a mild bearish bias targeting a re-test of 1.1820 / 1.1800 and the price behaviour should be monitored around this level due to its importance in relation to the current trading levels, in case the pair succeeded in building a base on the aforementioned level and returned again to breach 1.1880. A catalyst that increases the probability of contact with 1.1925 and 1.1970, respectively.

In the event that the pair confirms a break of 1.1800, that will be a signal for the beginning of downside moves, the official aim of which is to retest 1.1720, a correction of 23.60%.

| S1: 1.1815 | R1: 1.1880 |

| S2: 1.1765 | R2: 1.1925 |

| S3: 1.1720 | R3: 1.1970 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations