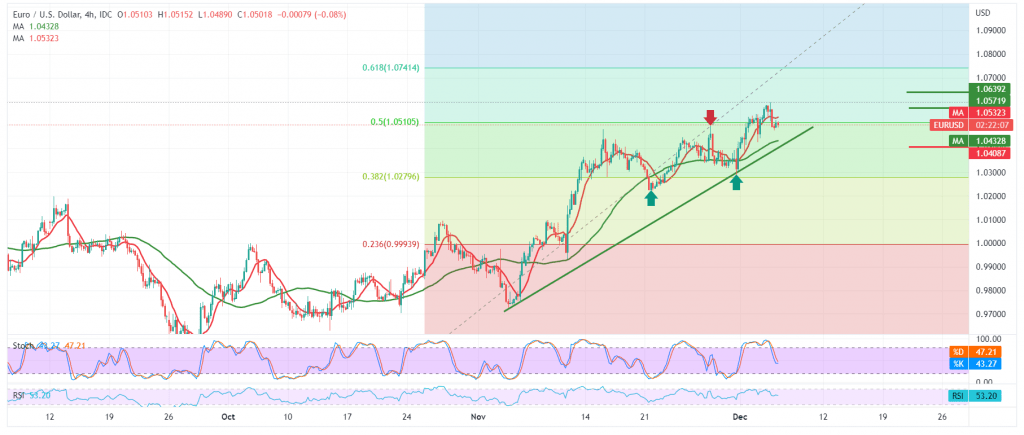

Little negativity dominated the movements of the EUR/USD pair as a result, after it witnessed substantial gains last Friday, heading to the downside due to the price approaching the resistance level of the psychological barrier 1.0600.

On the technical side, the support levels published in the previous technical report at 1.0475 succeeded in limiting the bearish bias, and the euro witnessed intraday stability above the level mentioned. With a closer look at the 4-hour chart, we find that the EUR/USD pair is now hovering around the pivotal level of 1.0150, represented by a correction. Fibonacci 50.0% is the key to protecting the bullish trend, and the 50-day simple moving average still holds the price from below, supporting the rise again.

We tend to be optimistic but cautious and must witness daily stability above 1.0475. Consolidation of the price above 50.0% Fibonacci correction around 1.0510, which increases the possibility of touching 1.0575 as a first target, knowing that breaching the mentioned level enhances the chances of visiting 1.0640, and the gains may extend towards 1.0690.

The decline below 1.0460 can thwart the current attempts to rise and put the price under strong negative pressure, with its initial target around 1.0400/1.0410.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0460 | R1: 1.0575 |

| S2: 1.0410 | R2: 1.0640 |

| S3: 1.0345 | R3: 1.0690 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations