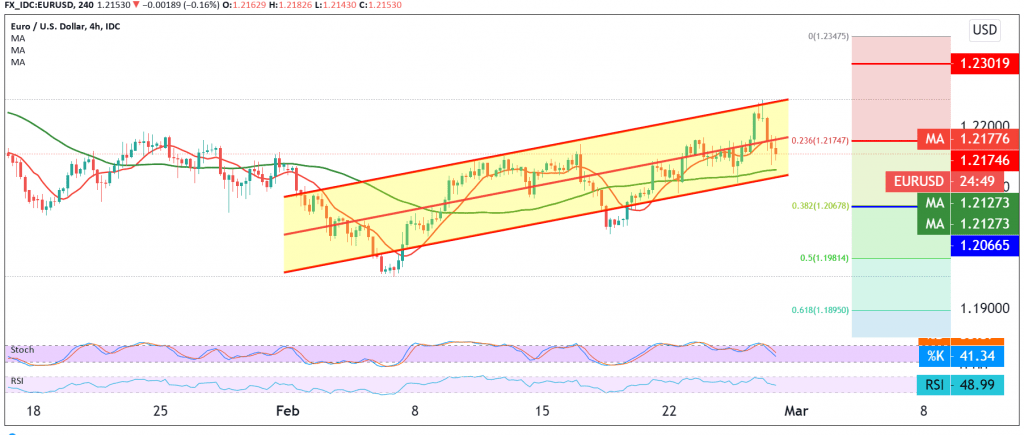

The Euro succeeded in achieving the expected positive outlook during the previous analysis, in which we relied on confirming the breach of 1.2175, heading for touching our second awaited target of 1.2235, recording its highest level at 1.2242.

Technically, and with a closer look at the 60-minute chart, we find that the current trading has returned to stabilize again below the resistance level of 1.2175, Fibonacci retracement of 23.60%, in addition to the negative intraday negative signals coming from the RSI on short intervals.

Therefore, we may witness a slight bearish tendency during the coming hours targeting a re-test of 1.2120/1.2110, knowing that the break of the latter increases the probability of retesting the pivotal support 1.2065 and the 38.20% retracement before resuming the rally again.

Crossing the upside to resistance and stabilizing the price above 1.2215 negates the activation of the bearish scenario during the coming hours, and the pair regains its upside path, its first target 1.2270, while its official target is 1.2300.

| S1: 1.2130 | R1: 1.2215 |

| S2: 1.2065 | R2: 1.2270 |

| S3: 1.2020 | R3: 1.2300 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations