Quiet trading tended to be negative, dominating the movements of the euro-dollar pair at the end of last week’s trading during the Thanksgiving holiday, to witness the current movements of the euro-dollar stabilizing around the lowest level during the early trading of the current session 1.0350.

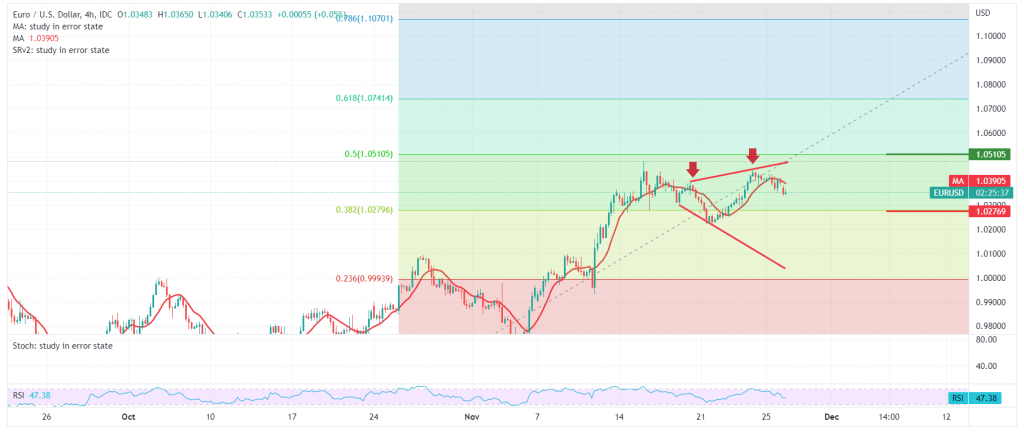

Technically, by looking at the 240-minute chart, we find that the simple moving averages are pressuring the price from below and support the possibility of a decline, in addition to the clear negative signs on the RSI and its stability below the mid-line 50.

In the coming hours, we may witness a bearish tendency, aiming to retest the strong support floor of 1.0280 before returning to the rise again, which is represented in the Fibonacci correction of 38.20%, as shown on the chart. The price behaviour should be closely monitored around this level due to its importance for the current week’s trading, and breaking it may extend the trend. The pair’s losses are waiting for it to touch 1.0225.

Stability in daily trading below 1.0410, and more importantly 1.0420, is a prerequisite for maintaining the bullish bias and consolidation above 1.0420, leading the pair to resume the rise towards 1.0520, an official awaited station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0320 | R1: 1.0410 |

| S2: 1.0280 | R2: 1.0465 |

| S3: 1.0225 | R3: 1.0520 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations