Quiet trading tended to be negative, dominating the euro’s movements against the US dollar in a gradual decline to the downside, reaching its lowest level during the previous session’s trading at 1.2010.

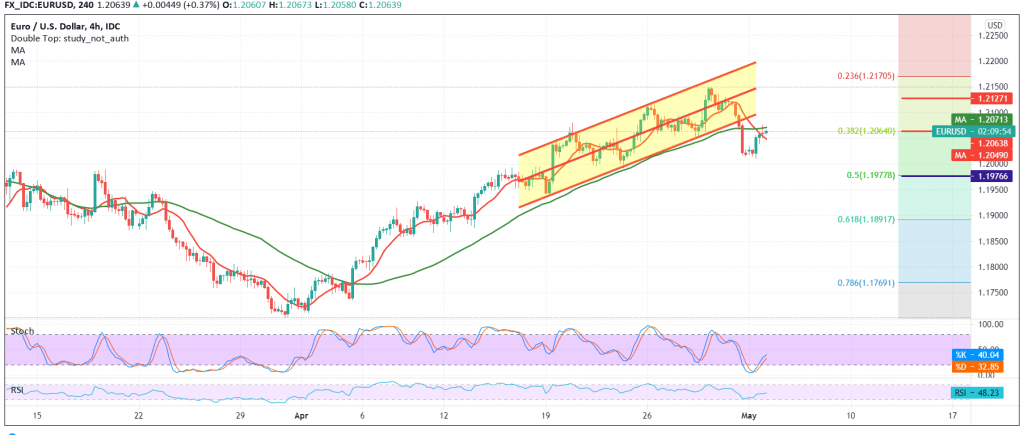

Technically speaking today, we see the euro trying to build a base on the support floor of the psychological barrier of 1.2000, which forced it to retest the resistance level 1.2065/1.2070.

With a closer look at the chart, we find the stochastic is heading towards overbought areas, and the 50-day moving average is still pressing the price from the top and meeting around 1.2065 Fibonacci retracement 38.20%, adding more chaos.

Therefore, we tend to be negative in our trading, maintaining the same target 1.1975 50.0% correction, knowing that breaking the aforementioned level may put the price under strong negative pressure, its next target 1.1920.

Only from the top is the price stability and surpassing the resistance level 1.2120/1.3130 is capable of foiling the bearish scenario, and we may witness a bullish path for the euro, targeting 1.2175, a correction of 23.60%.

| S1: 1.2000 | R1: 1.2135 |

| S2: 1.1975 | R2: 1.2230 |

| S3: 1.1920 | R3: 1.2290 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations