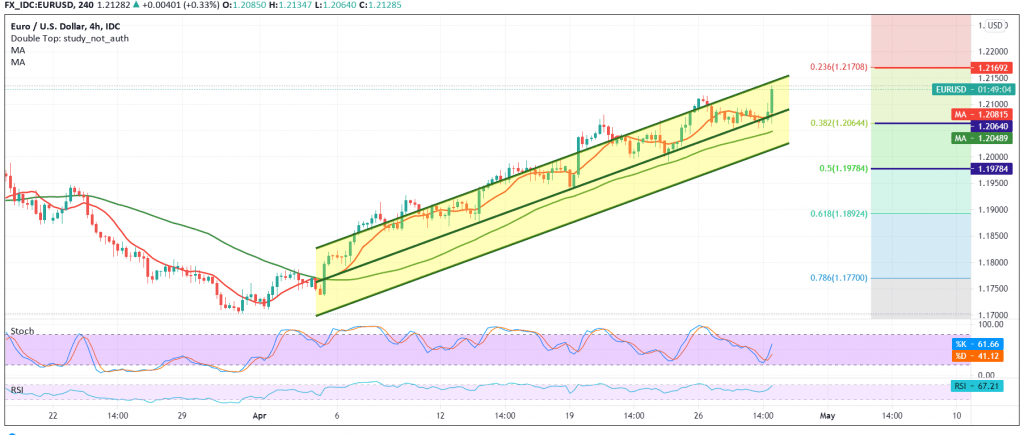

We committed to intraday neutrality in the previous analysis, explaining that for the continuation of activating long positions, we must witness an increase above 1.2060 for the pair to successfully retest the aforementioned support and start the bullish rebound again.

Technically, and with a closer look at the chart, we find that the simple moving averages are still in support of the bullish curve for prices, in addition to trading remaining above the support level of 1.2060 and generally above 1.2030.

Consequently, we will maintain our positive outlook targeting 1.2170, a next target represented by the 23.60% Fibonacci correction, knowing that breaching the aforementioned level is capable of enhancing the chances of the EUR rising towards 1.2200.

In general, we continue to suggest the upside move unless we witness any trading below 1.2030, because that puts the price under negative pressure, aiming to re-test 1.1975, a 50.0% correction.

| S1: 1.2030 | R1: 1.2135 |

| S2: 1.1975 | R2: 1.2175 |

| S3: 1.1925 | R3: 1.2235 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations