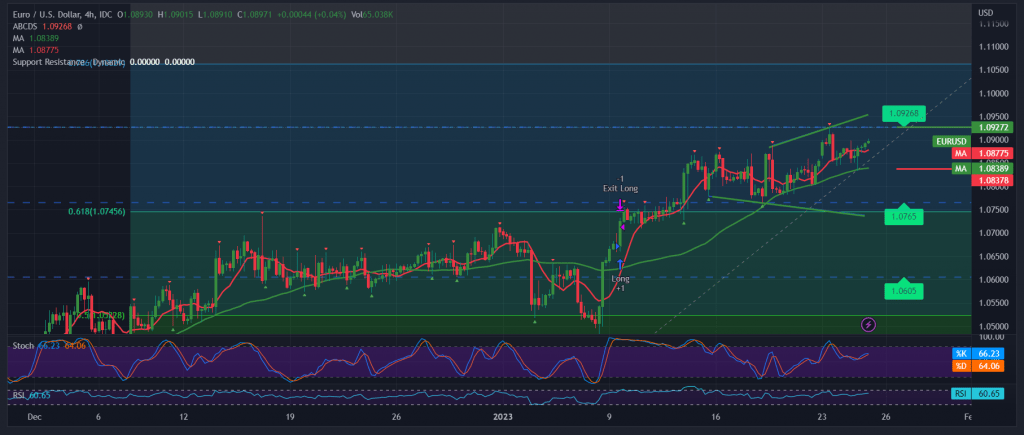

The technical outlook is unchanged, and the movements of the Euro-dollar pair did not undergo any significant change, including its success in achieving the idea of retesting the support published during the previous report at 1.0835, which forced it to rebound bullishly, and now hovering around the psychological barrier of 1.0900 during today’s morning trading.

On the technical side today, we maintain the same technical conditions of the previous trading session, and despite the clear negative features on the stochastic indicator, we find that the relative strength index continues to provide positive signals, maintaining stability above the mid-line 50, in addition to the pair continuing to receive a positive impulse from the simple moving averages.

Therefore, the bullish scenario remains valid and effective, continuing towards the official target of the previous report 1.0940, an official awaited station, knowing that its breach is a catalyst that increases and accelerates the strength of the bullish trend, to wait for 1.0970, and the gains may extend later towards 1.1030.

Activating the suggested scenario depends on trading consolidating above 1.0840, and we must be careful that the return of trading stability below the mentioned level leads the pair to retest the strong support floor 1.0745, 61.80% correction, before rising again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0835 | R1: 1.0940 |

| S2: 1.0770 | R2: 1.0970 |

| S3: 1.0725 | R3: 1.01035 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations