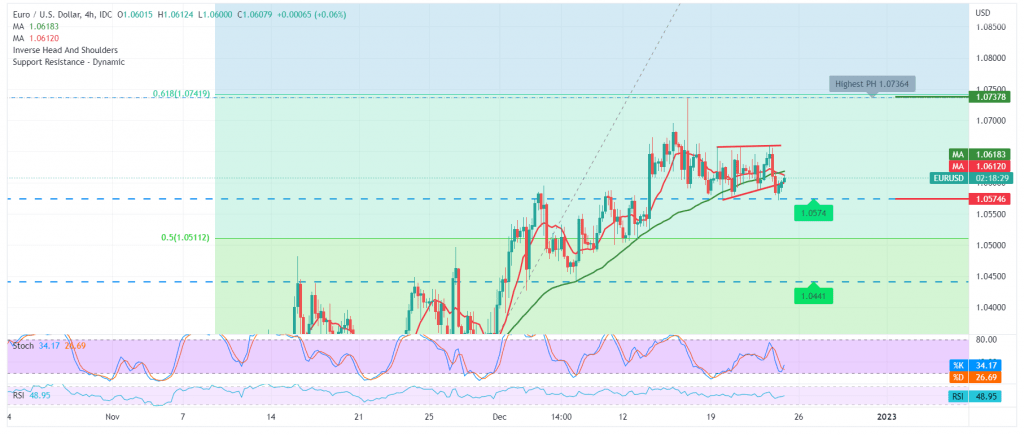

The Eurodollar pair’s attempts maintain the bullish context, trying to breach the strong resistance level at 1.0660, after it succeeded in building on the support 1.0570/10.580.

Technically, and by looking closely at the 240-minute chart, the simple moving averages are trying to pressure the price from above. On the other hand, positive signs started to appear on the stochastic indicator, accompanied by intraday stability above 1.0600.

We tend to rise, but with caution, targeting 1.0660 as a first target, considering that crossing to the upside and rising above the mentioned level extends the pair’s gains, to be waiting for 1.0740 Fibonacci correction 61.80%, the official waiting station.

Maintaining the bullish context requires daily trading to remain above the 1.0570 support. Breaking it will immediately stop any attempts to rise, and we will witness a retest of 1.0510, the 50.0% correction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0565 | R1: 1.0660 |

| S2: 1.0530 | R2: 1.0700 |

| S3: 1.0475 | R3: 1.0740 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations