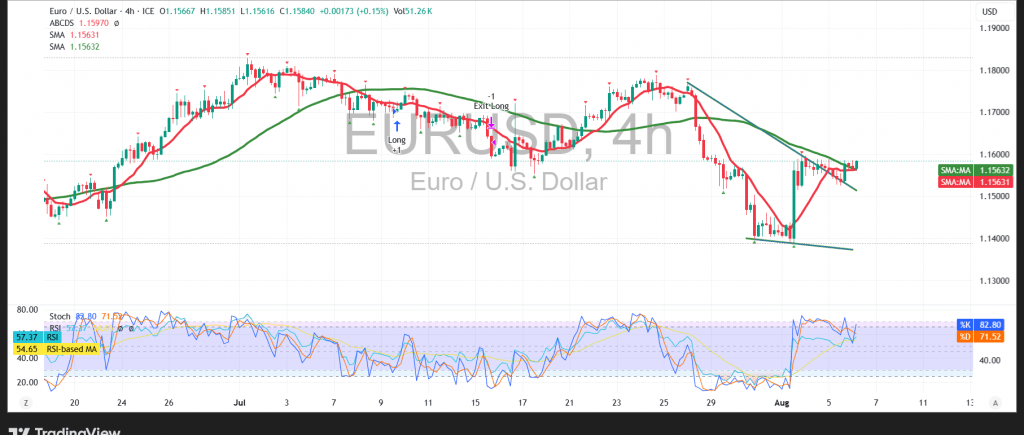

The euro is attempting to renew its bullish momentum against the U.S. dollar in early trading, after successfully holding above the key support level at 1.1525.

Technical Outlook:

The pair is currently trading near the session high of 1.1585. The chart indicates early signs of easing downside pressure from the 50-period Simple Moving Average (SMA), while the Relative Strength Index (RSI) is showing clear bullish signals, aiming to build upward momentum and support continued gains.

Probable Scenario:

As long as the pair holds above the 1.1540 level, the near-term outlook remains positive. A confirmed break above the psychological resistance at 1.1600 would likely act as a bullish catalyst, opening the way for further gains toward 1.1640 and 1.1665 as the next resistance zones.

Alternative Scenario:

On the other hand, if the pair fails to hold above 1.1540 and closes below it on the hourly chart, this may reintroduce downside pressure. In that case, a retest of the 1.1500 support level could occur before any renewed bullish attempts.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations