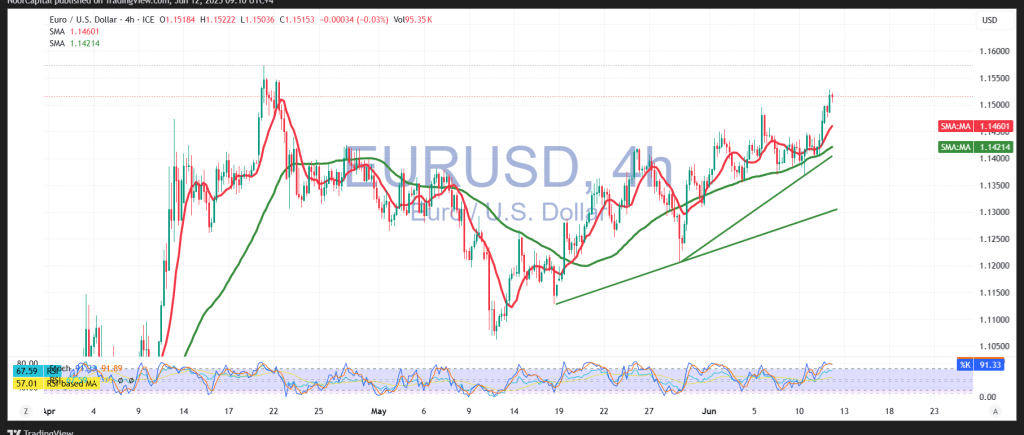

The EUR/USD pair maintained its upward momentum, aligning with the previously anticipated positive outlook. The pair successfully reached the official target of 1.1520, posting a session high of 1.1529.

From a technical standpoint, the bullish trend remains intact, supported by price stability above the simple moving averages, which continue to provide dynamic support. Additionally, the pair’s movement along the ascending trend line reinforces the prevailing positive structure.

As long as daily trading remains steady above the 1.1440 support level, further upside potential is favored. A push higher could lead the pair to test the next resistance at 1.1560. A confirmed break above this level would likely accelerate bullish momentum, paving the way toward the psychological barrier of 1.1600.

It is important to note that the validity of this outlook hinges on the pair maintaining daily closes above 1.1440. A drop below this level would delay, but not necessarily negate, the bullish scenario, potentially prompting a retest of the 1.1360 support zone before any renewed upside attempts.

Caution: Market participants should be aware that highly impactful economic data is scheduled for release today from the U.S., specifically the monthly and annual Producer Price Index (PPI). This could trigger significant price volatility.

Risk Reminder: Market conditions remain fragile due to ongoing global trade tensions. As such, all scenarios remain on the table.

Risk Disclaimer:

With ongoing global trade tensions and key economic data in focus, risk levels remain elevated. Traders should remain vigilant and prepare for potential sharp price swings in either direction.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations