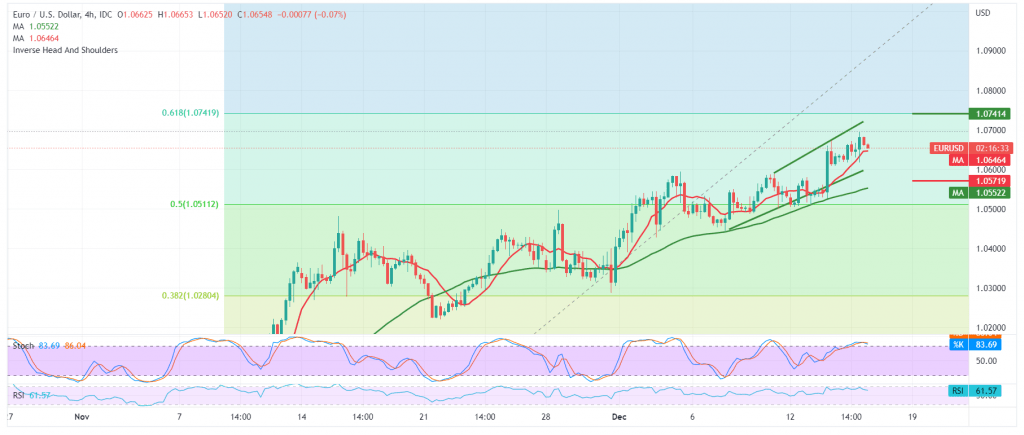

The EUR/USD pair continues its attempts to rise within the gradually ascending path, as we expected, recording its highest level during the previous session’s dealings, near the psychological barrier of 1.0700.

On the technical side today, and with a closer look at the 240-minute chart, we notice that the pair continues to receive a positive push from the Simple Moving Averages, and we find the pair to be stable during the day above the support level of 1.0600 accompanied by that.

The momentum indicator remains above the centre line 50, and on the other hand, we find negative signs starting to appear on the stochastic indicator, which indicates the possibility of a bearish regression before restoring the path.

We may witness a bearish bias in the coming hours, aiming to retest 1.0600 and 1.0570 before attempts to rise again, bearing in mind that the bearish bias does not contradict the daily bullish trend, whose first official target is located at 1.0740, Fibonacci correction of 61.80%, as long as the price is generally stable above it. 1.0510 retracement of 50.0%.

Note: We are waiting for high-impact economic data today, and we may witness obvious fluctuations at the time of the press release:

Interest rate decision from the Bank of England

Summary of monetary policy from the Bank of England

Monetary policy vote on interest rates from the Bank of England

The interest rate decision of the European Central Bank

European Central Bank monetary policy statement

ECB press conference

US retail sales

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0620 | R1: 1.0690 |

| S2: 1.0570 | R2: 1.0740 |

| S3: 1.0510 | R3: 1.0770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations