Negative trading dominated the euro’s movements against the US dollar with the conclusion of last week’s trading, touching our fourth official awaited target at 1.1885, and approaching a few points difference from the next target 1.1830, to record its lowest price at 1.1850.

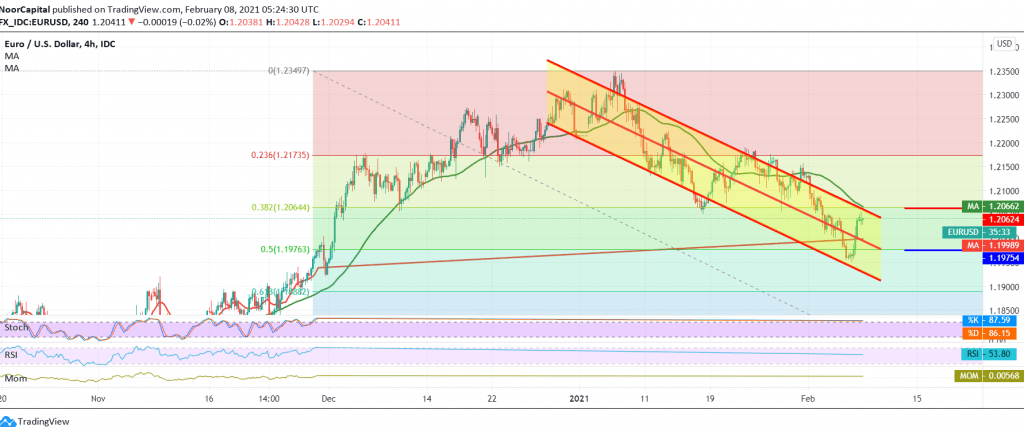

Technically speaking, the current movements are witnessing an upward tendency, which is a natural result after several consecutive sessions of retreat, and with a closer look at the 60-minute chart, we find there are positive signals from the RSI, accompanied by a positive stimulus coming from a 50-day moving average, on On the other side, we find the stochastic oscillator trading around overbought areas.

Consequently, with the conflict of technical signals, we will stand on the impartial momentary in order to maintain the profit rates that were achieved during the past week, so that we are waiting for one of the following scenarios:

The intraday stability is below 1.2065 the previously broken support, now converted to the 38.20% Fibonacci correction resistance, which supports the return of the bearish path with the target of 1.1975, the 50.0% correction, and extending later towards 1.1910.

Activation of long positions depends on confirming a breakout and stability above 1.2065, which is a catalyst that increases the probability of retesting 1.2175 23.60% retracement.

Note: the daily directional keys found above 1.2065 and below 1.1975. Therefore, the price behaviour of the pair should be monitored around these levels.

| S1: 1.1975 | R1: 1.2080 |

| S2: 1.1910 | R2: 1.2120 |

| S3: 1.1870 | R3: 1.2185 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations