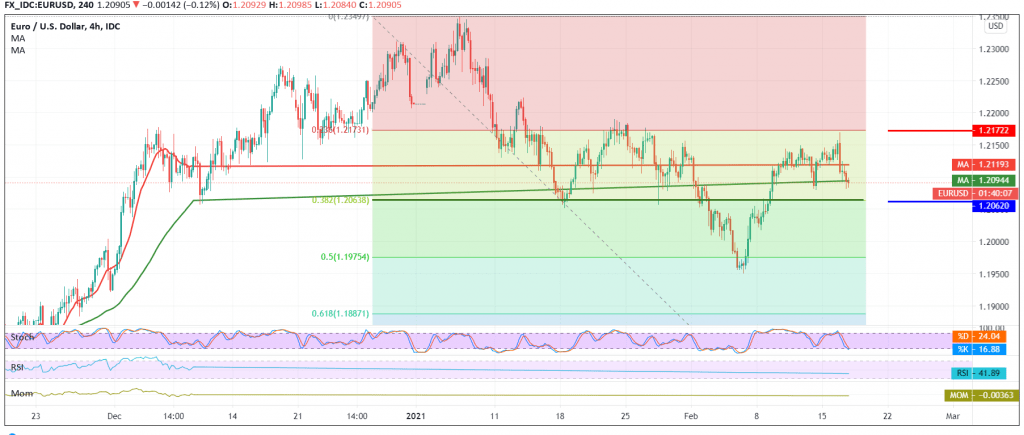

The single European currency found a strong resistance level around the first retest target to be achieved and mentioned during the previous analysis at 1.2175, to return again within a bearish path, targeting a re-test of the 1.2080 support level.

Technically, and with a closer look at the chart, a 60-minute chart, the current moves are witnessing stability below the minor resistance level of 1.2145/1.2150, and the simple moving averages have begun to pressure the price from the top.

Technical factors today indicate the possibility of a reversal, provided that the 1.2080 break is confirmed to target 1.2065 Fibonacci retracement 38.20% as shown on the chart. Also, it should be carefully noted that trading below 1.2065 accelerates and confirms the strength of the daily bearish trend, so that the way is directly open towards 1.2020 and 1.2000. Straight.

Only from the top, surpassing the upside resistance level at 1.2175, a correction of 23.60%, is capable of aborting the bearish scenario, and the pair will recover again, with the aim of 1.2220.

Note: Daily directional keys from below 1.2065 and from top at 1.2175.

| S1: 1.2065 | R1: 1.2145 |

| S2: 1.2025 | R2: 1.2175 |

| S3: 1.2025 | R3: 1.2230 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations