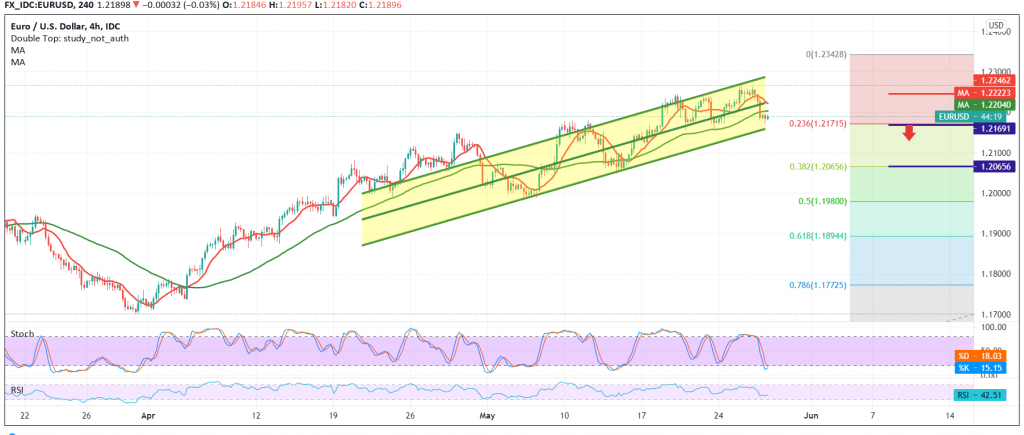

The euro found a strong resistance level during the previous trading session at 1.2170, which managed to limit the bullish tendency to force the euro to retest the support level of 1.2170.

Technically, and with a closer look at the 4-hour time frame, we find the 50-day moving average began to pressure the price from the top, supporting the occurrence of a bearish tendency during the day, and on the other hand, the stochastic indicator is still trying to obtain positive momentum accompanied by stability trading above the support level 1.2170.

With the conflict of technical signals, we will stand on the fence for a moment until the next trend becomes clearer in a more accurate way, so we will be in front of one of the following scenarios:

Activating short positions requires intraday stability below 1.2200, and most importantly 1.2240. We also need to witness a clear breach of the important support level of 1.2170, a correction of 23.60%, which leads the pair to a downside path, its initial target is around 1.2120, and then 1.2065 correction of 38.20%, the next official station.

Activating long positions depends on crossing to the upside and rising again above 1.2240, which would lead the pair to resume the rise with targets starting at 1.2300 and extending towards 1.2335.

| S1: 1.2170 | R1: 1.2250 |

| S2: 1.2120 | R2: 1.2300 |

| S3: 1.2065 | R3: 1.2335 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations