The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the bullish scenario and subject the pair to negative pressure. This was confirmed as the euro reached a low of 1.1032 in early trading today.

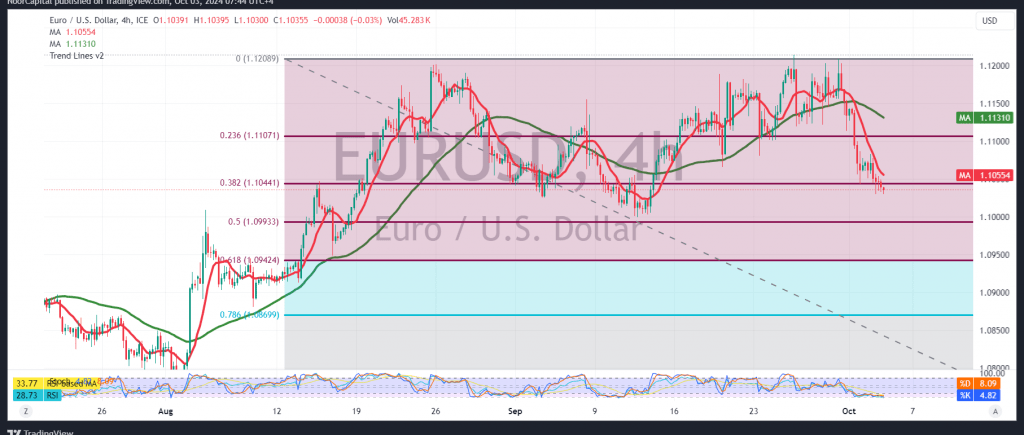

From a technical perspective, the 4-hour chart shows the pair testing the support at 1.1040, corresponding to the 38.20% Fibonacci retracement level. Simple moving averages continue to exert downward pressure on the price.

With intraday trading remaining below the 1.1070 resistance level, and more broadly below the previous support turned resistance at 1.1100 (23.60% Fibonacci retracement), a bearish trend is likely in the coming hours. The first target is 1.0995/1.1000, with potential losses extending to 1.0940.

However, a confirmed upward breakout of 1.1070, and then 1.1100, would allow the pair to regain its bullish path, potentially opening the way for gains towards 1.1140 and 1.1180.

Warning: Today, we expect high-impact economic data from the US, including “Unemployment Benefits” and “ISM Services PMI.” Significant price volatility may occur upon the news release.

Caution: The risk level remains high amidst ongoing geopolitical tensions, and all scenarios are possible.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations