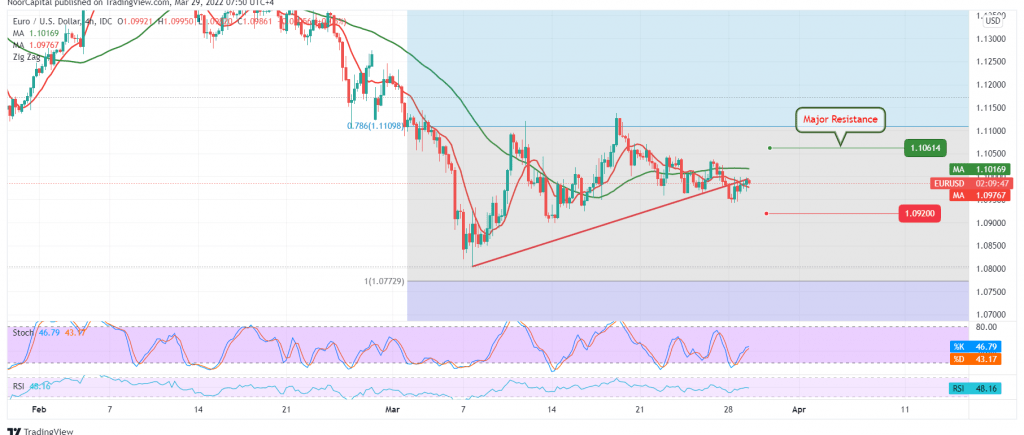

The single European currency provided positive trades during the previous trading session. It approached the 1.0920 support level, recording the lowest price at 1.0940, forcing it to form a limited bullish bounce to retest the psychological resistance level 1.1000.

Technically, by looking at the 4-hour chart, we notice that the 50-day moving average is still an obstacle for the pair and meets near the resistance level of 1.1030 and adds more strength to it, in addition to the negative features started to appear on the stochastic.

Therefore, the bearish scenario is still the most likely during today’s trading, targeting 1.0955 and 1.0920 next official station, knowing that breaking the latter leads the euro to make more concessions to visit 1.0875 as long as the price is stable below 1.1030 and most importantly 1.1060.

Consolidation above the resistance level of 1.1060 can thwart the bearish scenario and lead the pair to temporary bullish moves targeting 1.1100.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0955 | R1: 1.1010 |

| S2: 1.0920 | R2: 1.1065 |

| S3: 1.0875 | R3: 1.1105 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations