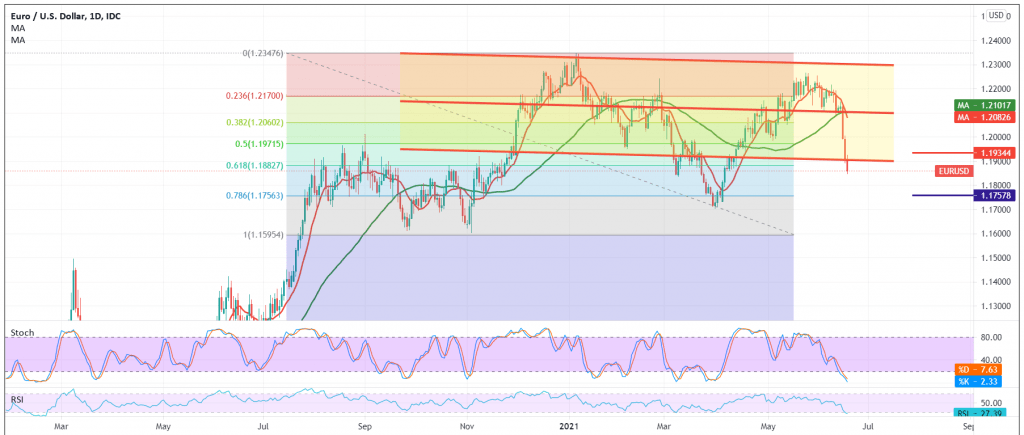

The bearish wave is still dominating the euro against the US dollar after slight positive movements through which the pair returned the previously broken support level 1.1880/1.1890.

Technically, the bearish trend is still a valid and effective scenario, as a result of the pair continuing to obtain negative pressure coming from the simple moving average, in addition to the clear negative signs on the RSI.

From here and steadily trading intraday below 1.1880 Fibonacci corrections of 61.80%, the bearish scenario is the most preferred, targeting 1.1800 first target and then 1.1750 next official stations.

From the top, rising again above 1.1900, and most importantly 1.1930 postpones the chances of a decline but does not cancel them, and we may witness a retest of 1.1960 and 1.2000 before attempts to decline again.

| S1: 1.1800 | R1: 1.1960 |

| S2: 1.1745 | R2: 1.2060 |

| S3: 1.1650 | R3: 1.2120 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations