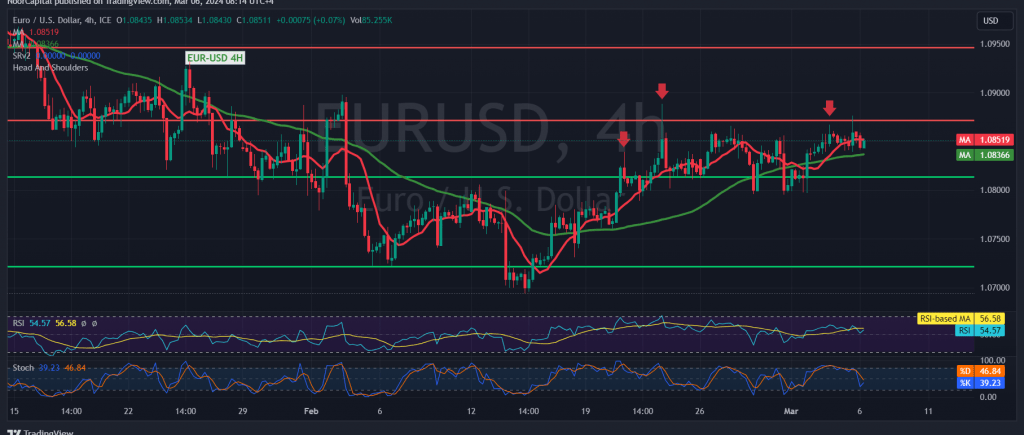

The technical outlook for the EUR/USD pair remains consistent, with no significant deviation from the previous analysis. The pair continues to trade within the established sideways price range, bounded by support near 1.0800 and resistance around 1.0860.

Examining the 4-hour chart, we observe that the 50-day simple moving average continues to provide support for the upward trajectory of prices. Additionally, there is stability in trading above the psychological support level of 1.0800. However, the pair remains capped below the robust resistance at 1.0860, accompanied by signals of negative crossovers on the stochastic indicator.

Given the conflicting technical signals and the constrained trading range between 1.0800 and 1.0860, it is prudent to monitor the price action for potential developments:

- A sustained breach above the 1.0860 resistance level would signal an upward trend, potentially paving the way for further gains towards 1.0930 and 1.0960.

- Conversely, a break below 1.0800 could indicate a bearish trend, targeting initial support at 1.0765, followed by 1.0740.

Warning: Today’s trading activity may be influenced by high-impact economic data releases from the American economy, including changes in private non-agricultural sector jobs, job vacancies, and the labor turnover rate, as well as testimony from the Federal Reserve Governor. Additionally, from Canada, attention is on the interest rate decision and the Bank of Canada press conference. Expect elevated volatility during these news releases.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations