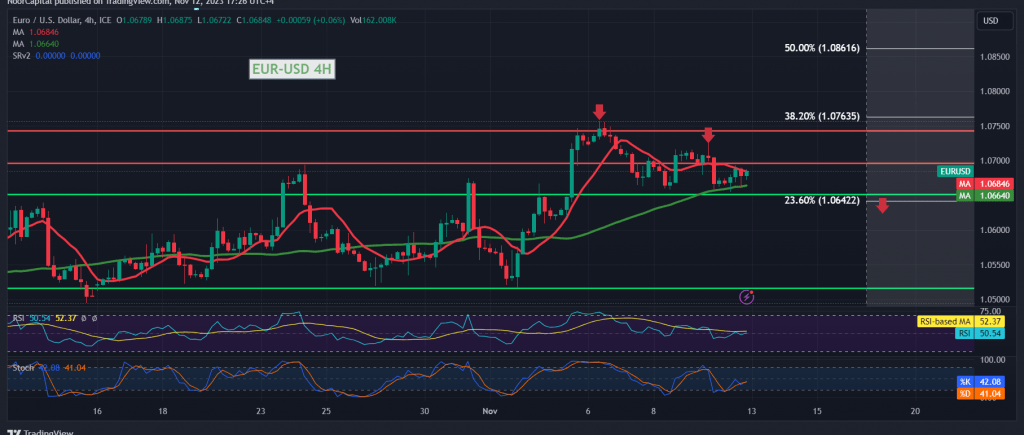

The technical outlook for the pair remains consistent, with no significant changes observed in its movements. The bearish trend persisted, concluding last week’s trading above the crucial 1.0640 support level.

In today’s technical analysis, we are inclined towards a negative outlook in our trading approach. This is based on the sustained negative impact of the bearish technical formation observed on the 4-hour time frame, coupled with clear negative crossover signals on the Stochastic indicator.

As such, the likelihood of a bearish bias is prominent. However, we prefer to see a distinct and robust breach of the primary support level at the current trading levels of 1.0640, marked by the 23.60% Fibonacci retracement. This breakthrough would facilitate a move towards 1.0600 and then 1.0565 as the subsequent target.

Should the pair manage to consolidate above 1.0640 and resume trading beyond 1.0760, such a scenario would thwart any downward attempts. In this case, the pair could initiate an upward correction, with targets starting at 1.0800 and extending to 1.0840.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations