The Euro approached the target mentioned in the previous analysis at 1.1970, reaching a low of 1.1998.

Technically speaking, we find that the pair managed to find decent support around the psychological barrier of 1.2000 within attempts to rise again.

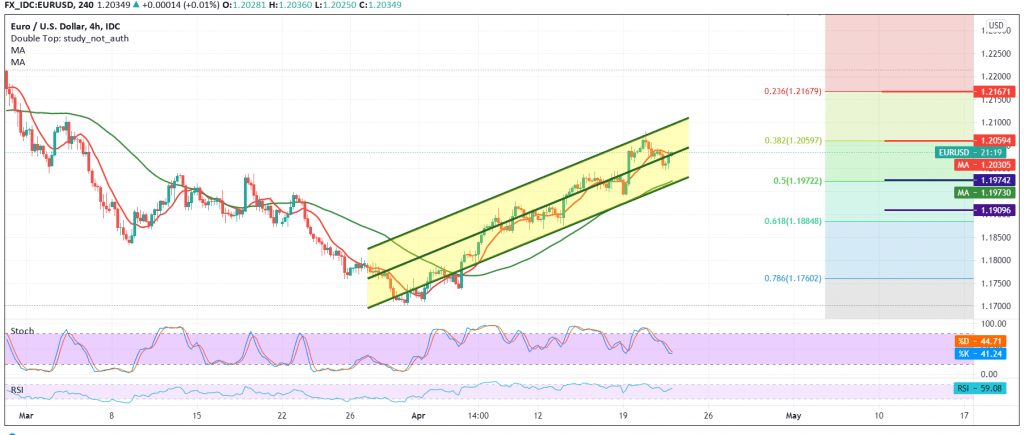

With a closer look at the 240-minute chart, we find a conflict between the positive motive of the 50-day moving average, which meets around 1.1970 and adds more strength to it, and the clear negativity features on the stochastic indicator.

Therefore, we prefer to stand aside until the daily trend becomes clearer, to be in front of one of the following scenarios: To maintain the bullish trend, we need to witness intraday stability above 1.2000 and most importantly 1.1790, 50.0% retracement. We also need to witness a clear and strong breach of the resistance level 1.2060 correction 38.20%, which is a catalyst. To enhance the chances of a rally towards 1.2120, and the EUR’s gains may extend to 1.2160 later.

Short positions depend on a clear break of the 1.1975 support level, which puts the price under negative pressure, its initial target 1.1910.

| S1: 1.1990 | R1: 1.2075 |

| S2: 1.1960 | R2: 1.2120 |

| S3: 1.1910 | R3: 1.2160 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations