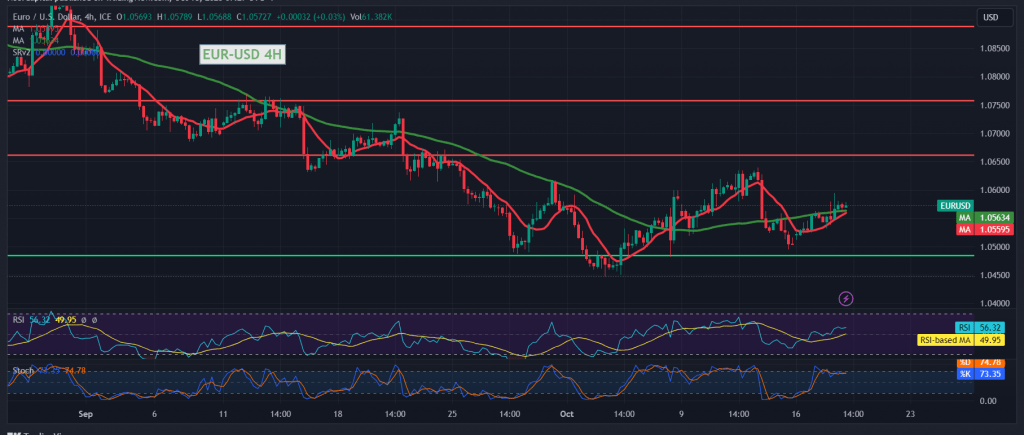

The EUR/USD pair’s movements witnessed a positive trend during the previous trading session, reflecting the expected downward trend. In this trend, we relied on trading stability below the 1.0550 resistance level when the report was published. The price’s consolidation above 1.0570 postpones the chances of a decline but does not eliminate them. We may witness a retest of 1.0600, recording the highest level. He has 1.06597, offsetting the long position.

Technically, looking at the 4-hour time frame chart, we find that the pair achieved immediate stability above the previously breached resistance level of 1.0540, accompanied by a positive stimulus from the 50-day simple moving average.

Therefore, the upward path could resume, but only if we witness a clear and strong breach of the resistance level of the psychological barrier 1.0600, which would enhance the chances of a rise to visit 1.0640 and 1.0670, respectively.

As a reminder, the return of trading stability and the closing of the hourly candle below 1.0540 renews the chances of negative pressure to retest 1.0500, and it may extend later towards 1.0470.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations