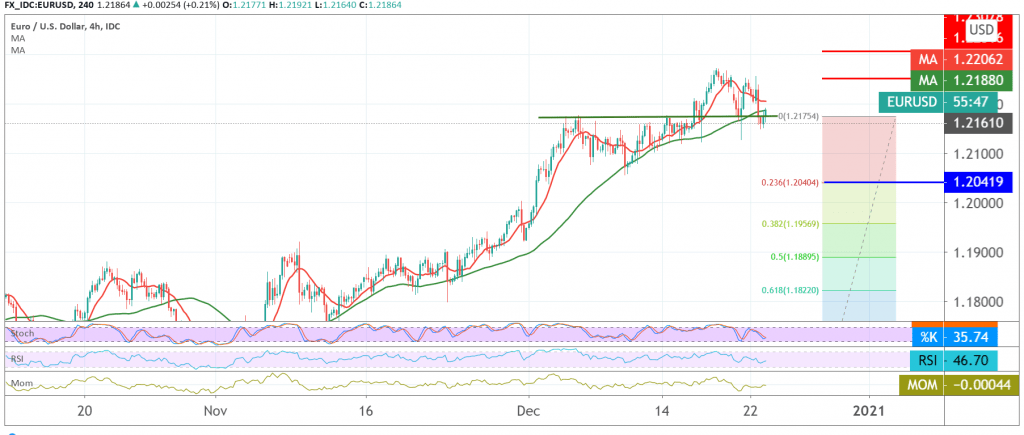

The resistance levels published during the previous analysis, located at 1.2250, managed to limit the bullish bias to force the pair to retreat again, targeting a re-test of the support level represented by our first target of 1.2150, to record a low of 1.2152.

Technically speaking, and by looking at the 4-hour chart, we find that the pair is hovering around the 50-day moving average, and we find negative features still dominating the stochastic indicator, on the other hand, the RSI tries to provide a positive signal on short time frames.

During the next hours, with the price stabilizing above 1.2150, the possibility of witnessing a slight bullish bias targeting 1.2250 before resuming the decline again increases. Noting that trading below 1.2150 facilitates the required task towards 1.2090, and then 1.2040 Fibonacci retracements of 23.60%.

A reminder that surpassing the upside and rising above 1.2250 will stop the bearish scenario and see the euro witnessing a recovery targeting 1.2300.

| S1: 1.2140 | R1: 1.2250 |

| S2: 1.2090 | R2: 1.2305 |

| S3: 1.2035 | R3: 1.2350 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations