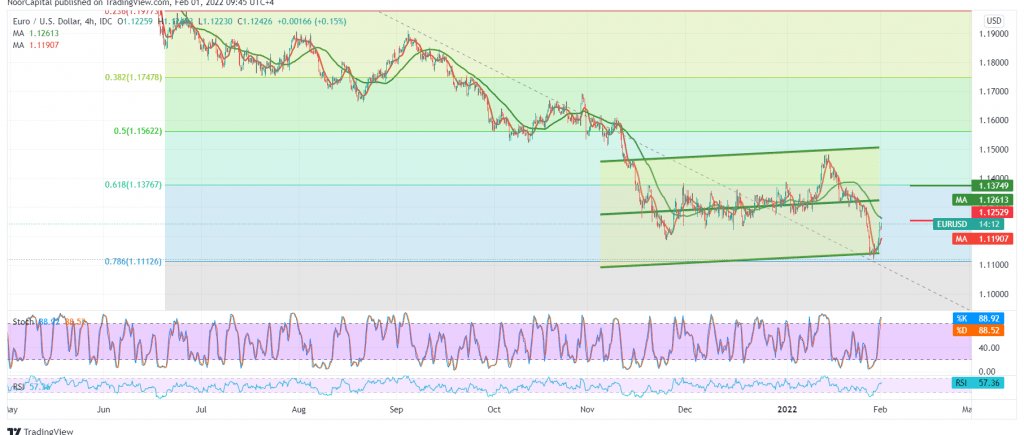

We adhered to neutrality during yesterday’s technical report due to the conflicting technical signals, clarifying that the pair is trying to build a base on the psychological support level 1.1100 to start its daily trading on an upward trend, above 1.1235.

On the technical side today, the 4-hour chart indicates the possibility of a bullish bias in the coming hours, as a result of the positive reading of Stochastic, which is trying to get more bullish momentum, in addition to the attempts of the 14-day momentum indicator to provide positive signals.

With daily trading remaining above 1.1150, the bullish bias may be the most preferred, and the pair may witness a retest of the 1.1380 key supply point represented by the 61.80% Fibonacci correction.

Activating the above-suggested scenario requires stability above 1.1150, and breaking it may lead the euro to the downside with a target of 1.1100 and extending later towards 1.1060 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1170 | R1: 1.1285 |

| S2: 1.1100 | R2: 1.1330 |

| S3: 1.1060 | R3: 1.1395 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations