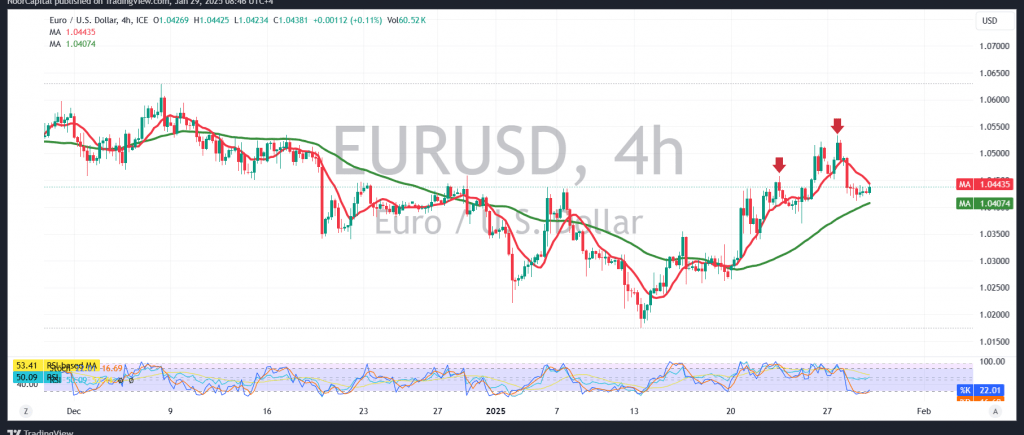

The EUR/USD pair remains in narrow sideways trading, gradually declining toward the first target of 1.0400, after recording its lowest price at 1.0414.

From a technical analysis perspective, the 4-hour chart shows the pair stabilizing below the key resistance levels of 1.0460 and, more importantly, 1.0485. Additionally, the 14-day momentum indicator continues to provide negative signals.

As long as intraday trading remains below 1.0460, the bearish trend is likely to persist, targeting 1.0400. A confirmed break below this level could accelerate losses, opening the door for a decline toward 1.0360, with a potential extension to 1.0325.

On the upside, stability above 1.0485 for at least an hourly candle could trigger a recovery, leading to a retest of 1.0530, followed by 1.0565.

Caution: Today, high-impact economic data from the U.S. economy—including the Federal Reserve statement, Fed Chair press conference, and interest rate decision—along with Canada’s interest rate announcement and Bank of Canada monetary policy statement, could lead to significant price volatility at the time of release.

Risk Disclaimer: The current geopolitical landscape adds further uncertainty, making all scenarios possible.

Caution: The risk remains elevated due to ongoing geopolitical tensions, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations