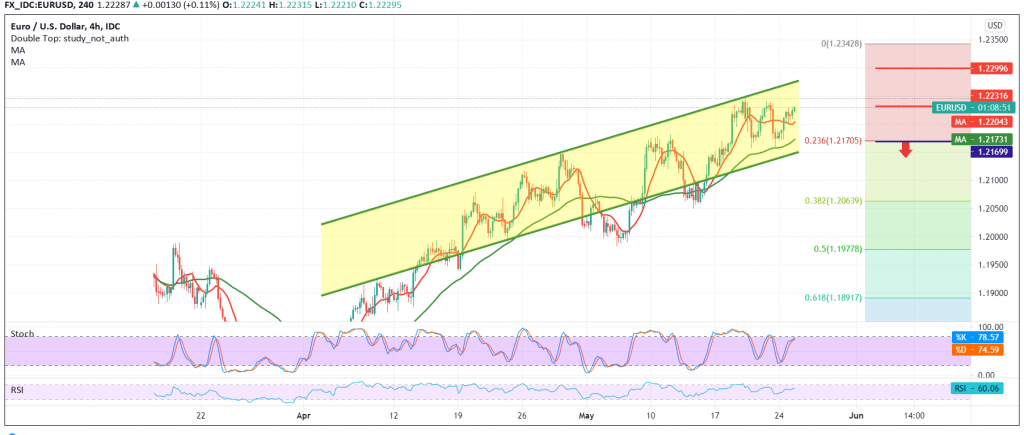

Quiet trading dominated the movements of the euro against the US dollar, but trading tended to be positive within the awaited bullish context touching the first target required to be achieved in the previous analysis, located at 1.2230, to record its highest level at 1.2231.

Technically speaking, and with a closer look at the chart, a 60-minute chart, we find the euro is still stable above 1.2170 located at Fibonacci retracement of 23.60, and the 50-day moving average is still holding the price from the bottom and supports a bullish curve for prices accompanied by the positive signs coming from the RSI .

With trading remaining above 1.2170 and most importantly 12145, this encourages us to maintain our positive outlook, provided confirmation of the breach of 1.2230, bearing in mind that confirming the breach of the aforementioned level is a catalyst that enhances the chances of a rally towards 1.2275 and targets may extend later to visit 1.2300.

Only from below is the confirmation of a break of 1.2170 that puts the price under strong negative pressure, its initial target is around 1.2110, while its official target is 1.2065, and the 38.20% retracement.

| S1: 1.2145 | R1: 1.2230 |

| S2: 1.2105 | R2: 1.2275 |

| S3: 1.2065 | R3: 1.2305 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations