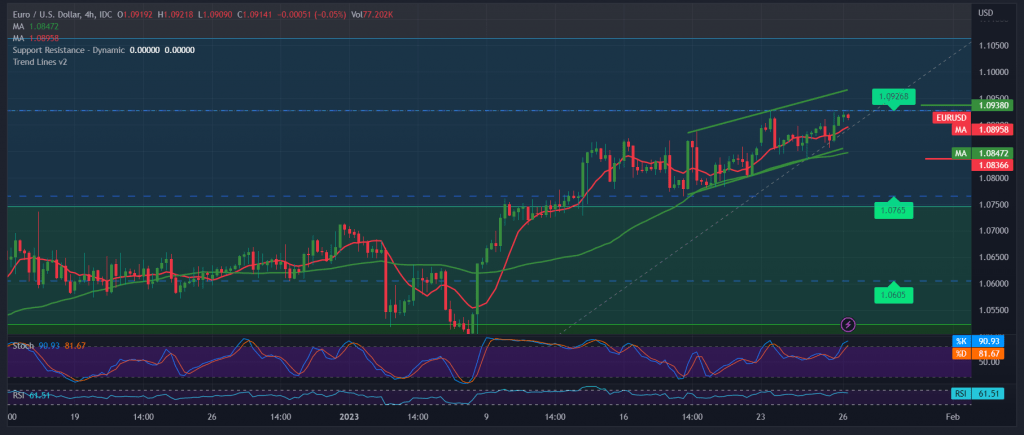

A quiet, gradual rise dominates the movements of the EUR/USD pair within the expected bullish path, gradually approaching the official station targeted for the current wave of rise 1.0940, recording its highest level at 1.0924.

On the technical side, the pair established a solid floor around 1.0835. The simple moving averages continue to hold the price from below, motivated by the positive signs of the 14-day momentum indicator.

From here, and with the Eurodollar pair maintaining the same technical conditions supporting the continuation of the rise, therefore the bullish scenario remains intact towards the official target of the previous report 1.0940, an official awaited station, knowing that its breach is a catalyst factor that increases and accelerates the strength of the bullish trend, to be waiting for 1.0970, and it may extend gains later towards 1.1030.

Activating the suggested scenario depends on trading consolidating above 1.0830, and we must be careful that the return of trading stability below the mentioned level leads the pair to retest the strong support floor 1.0745, 61.80% correction.

Note: Stochastic is around the intraday overbought areas, and we may witness some fluctuation until we get the official trend.

Note: Today, we are awaiting high-impact economic data issued by the US economy; The estimated reading of the quarterly GDP, and we may witness a high fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0870 | R1: 1.0940 |

| S2: 1.0830 | R2: 1.0970 |

| S3: 1.0775 | R3: 1.01035 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations