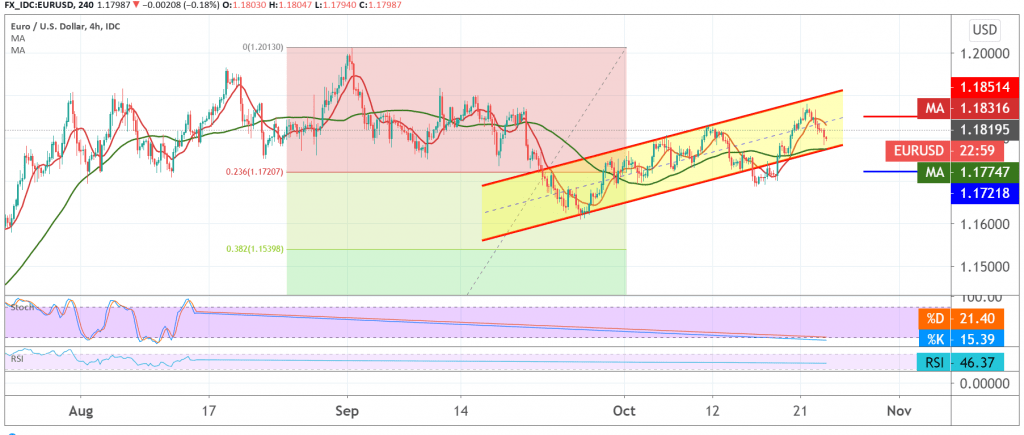

Trading tended to be negative and dominated the euro’s movements against the US dollar within the scenario of retesting the support as it’s close to the published target located at 1.1775, to settle for a low of 1.1685.

Technically speaking, looking at 240-minutes chart, we find that the Euro started to pressure the support floor of 1.1785 and needs to break it to continue its decline with the RSI indicator continuing to provide negative signals.

From the upside, stability above 1.1850 delays the chances of a reversal but does not negate them, while trading above the 1.1880 resistance level is able to negate the bearish scenario and restore the pair to recover, so we are waiting for 1.1945 / 1.1930.

| S1: 1.1765 | R1: 1.1850 |

| S2: 1.1720 | R2: 1.1900 |

| S3: 1.1675 | R3: 1.1945 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations