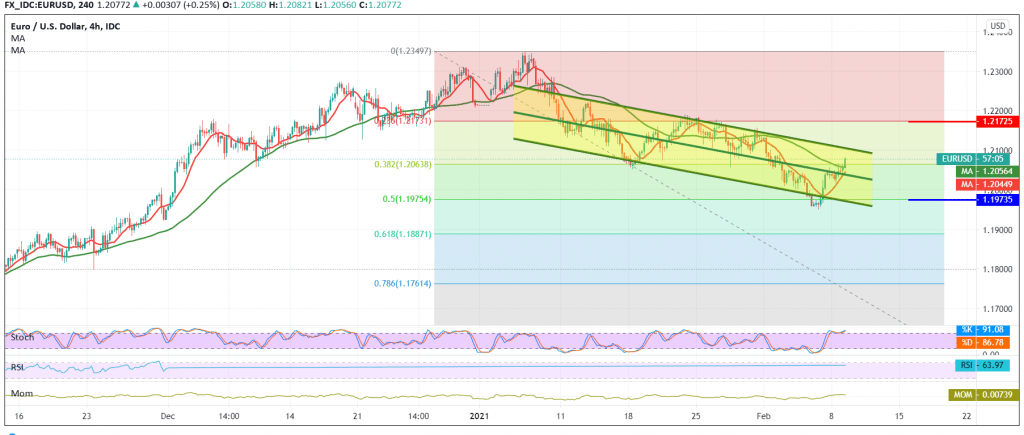

We committed to the intraday neutrality in the previous analysis due to the conflicting technical signals, indicating that the 1.2065 level from the top and the 1.1975 level are the directional keys for the current week’s trading.

On the technical side, we find the euro is starting positively, trying to breach the level of 1.2065 Fibonacci corrections 38.20% as shown on the 4-hour chart, and we find the 50-day moving average trying to provide a positive motive, and on the other hand, we find the stochastic indicator trading around the overbought phase.

We prefer to wait until the breach of 1.2065 and then 1.2095 is confirmed, as a start for the pair to retest 1.2175 Fibonacci 23.60% before continuing to decline again.

Trading below 1.2020 will renew the chances of a decline towards 1.1975. It should also be noted that trading below 1.1975 confirms the return of the bearish context with the initial target of 1.1920.

| S1: 1.2040 | R1: 1.2100 |

| S2: 1.1995 | R2: 1.2130 |

| S3: 1.1965 | R3: 1.2160 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations