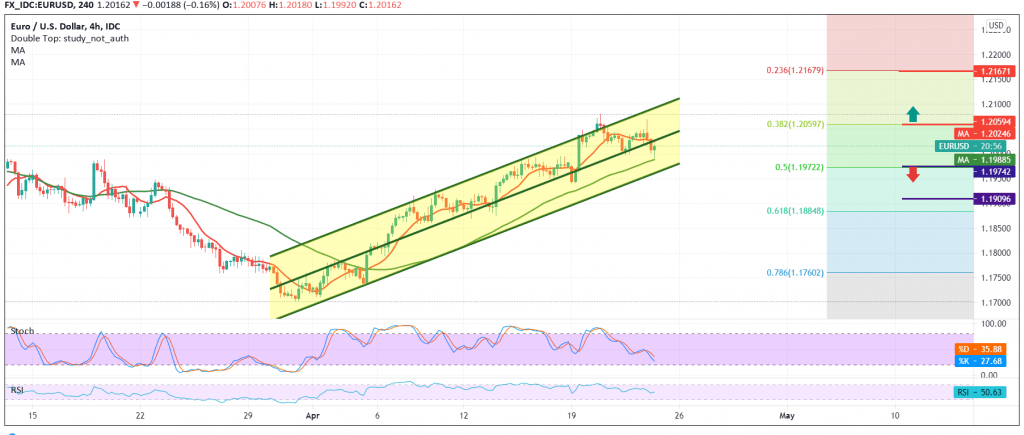

Quiet trading dominated the movements of the euro against the US dollar during the previous trading session, as the pair found a strong resistance level around 1.2065.

On the technical side today, the intraday trading is still stable below the resistance level of 1.2065 Fibonacci retracement of 38.20%, as we find the stochastic indicator tends to be negative.

Therefore, we may be facing a scenario of re-testing the support level of 1.1975, a correction of 50.0%, as a first target, and the price must be monitored well in case the aforementioned level is touched because breaking it puts the price under strong negative pressure to target 1.1910.

If the pair succeeds in building a base on the support floor of 1.1975 and resuming its move up to the resistance level of 1.2060, this is a catalyst that increases the probability of resuming the rise again, so that the path will be open directly towards 1.1210.

| S1: 1.1980 | R1: 1.2060 |

| S2: 1.1950 | R2: 1.2105 |

| S3: 1.1900 | R3: 1.2140 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations