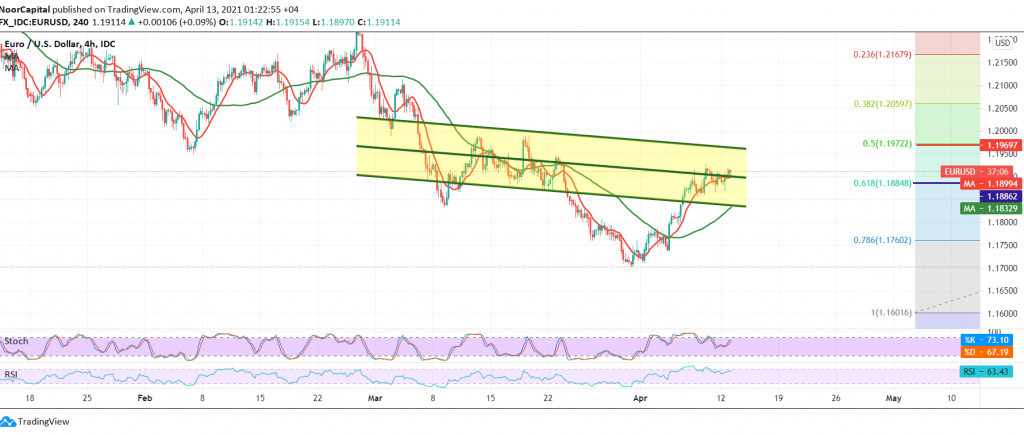

The pair provided calm, positive trading, benefiting from stability above the strong support level at 1.1880, as part of attempts to stabilize above the psychological barrier of 1.1900.

Technically speaking and with a closer look at the 60-minute chart, we find the 50-day moving average trying to provide a positive incentive to push the price up, by moving on the 240-minute time frame, we find the stochastic is still providing negative signals.

Although we tend to be positive, but with the continuing conflict of technical signals, we will stand on the fence for the second session in a row until a more accurate picture appears, so we will be in front of one of the following scenarios:

Activating long positions depends on the stability of the intraday trading above 1.1885/1.1880, 61.80% correction, and in general above 1.1860. We also need to witness a clear and strong breach of the 1.1925 resistance level in order to enhance the chances of an upside move towards 1.1975, a 50.0% retracement.

Activation of short positions will be confirmed by a break of 1.1960, which leads the price to a downside path, the primary objective of which is to re-test 1.1800 initial stations.

| S1: 1.1880 | R1: 1.1935 |

| S2: 1.1850 | R2: 1.1965 |

| S3: 1.1800 | R3: 1.2000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations