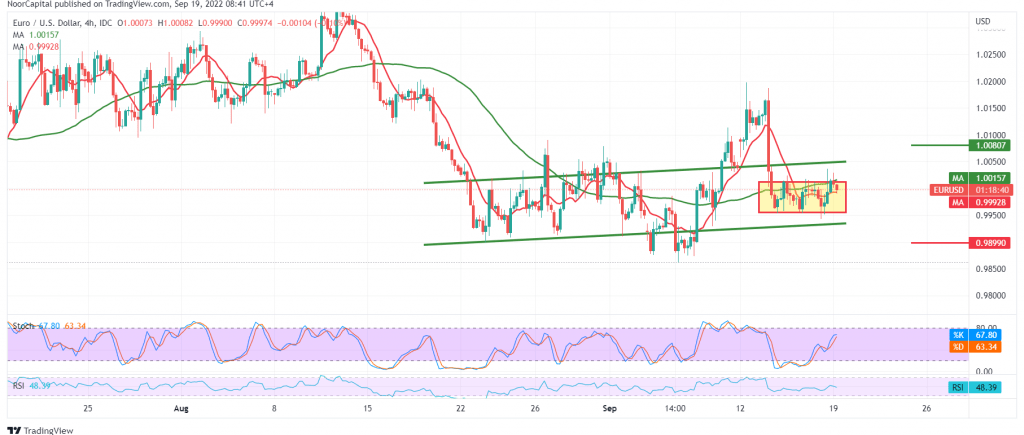

Limited sideways trading tended to the negativity dominating the movements of the euro against the US dollar, and the current moves are witnessing the stability of the pair’s exchange rate below the parity point of 1.0000, which constitutes a pivotal level for the current trading levels.

Technically, by looking at the 4-hour chart, we find that trading is restricted from below above 0.9960 and from above below 1.0000. With careful consideration, we find the 5-day simple moving average still constitutes an obstacle for the pair accompanied by negative features on the stochastic indicator.

We tend to the negativity, but with caution, targeting 0.9950 first target, and breaking it will facilitate the task required to visit 0.9910, an official waiting for station unless we witness any trading above 1.0040.

The rise and consolidation above 1.0040 stop the expected decline and leads the pair to a temporary recovery, targeting 1.0080 and 1.0120, before starting the decline again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9950 | R1: 1.0040 |

| S2: 0.9900 | R2: 1.0080 |

| S3: 0.9855 | R3: 1.0130 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations