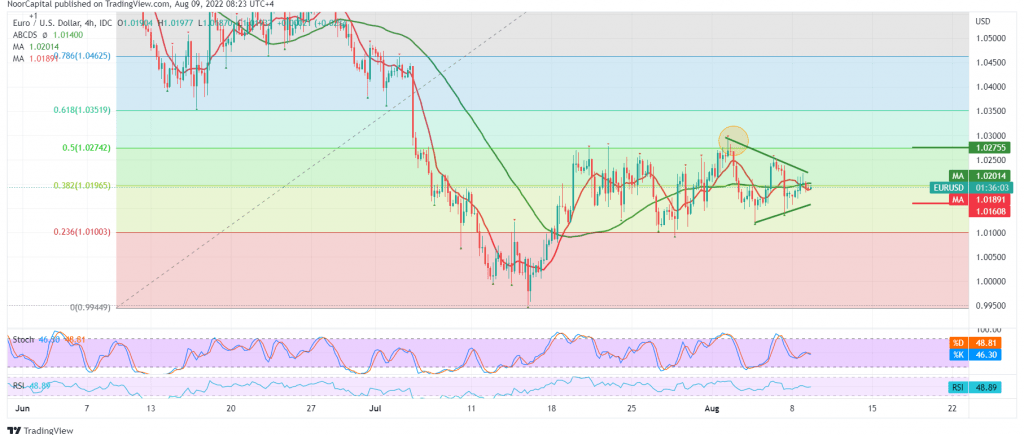

The movements of the EUR/USD pair witnessed positive attempts at the beginning of the first trading of this week, but still limited positive, with the stability of trading below the resistance level of 1.0240.

The technical aspect refers to the conflict of technical signals, and we note the negative pressure of the simple moving averages in conjunction with the clear negative features on the stochastic indicator, in addition to the stability of the intraday trading below 1.0240 and in general below the pivotal resistance 1.0275 and this supports the negativity, on the other hand we find the pair coherent above the support floor 1.0160 accompanied by positivity Momentum indicator 14 days.

With conflicting technical signals, trading from below above 1.0160 and from above below 1.0275, we prefer to monitor the price behavior of the pair and wait for the activation of the following pending orders:

Price stability above 1.0160 and confirmation of the breach of 1.0275 50.0% Fibonacci retracement is a catalyst that enhances the chances of rising to visit 1.0300 and 1.0350, retracement of 61.80%, respectively.

Below 1.0160, the euro is witnessing a negative trading session that starts at 1.0130 and extends towards 1.0100.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0160 | R1: 1.0275 |

| S2: 1.0100 | R2: 1.0300 |

| S3: 1.0065 | R3: 1.0355 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations