The Eurodollar pair achieved limited gains during the previous trading session after consolidating above the psychological barrier 1.1000, close to the required target 1.1090, to record its highest level at 1.1070.

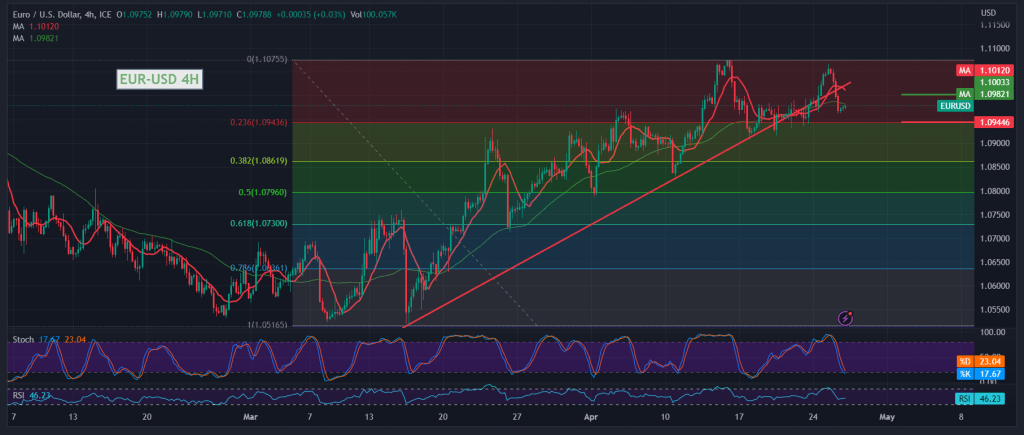

Technically, The pair found a strong resistance level at 1.1070, which forced it to retreat and witness stability again below the resistance of the psychological barrier 1.1000, and with a close look at the 4-hour chart, we find the 50-day simple moving average returned to pressure the price from Upwards, as we find the pair started to pressure the support of the ascending channel around 1.0940/1.0945, and on the other hand, we find the stochastic indicator on the verge of oversold.

With conflicting technical signals, we prefer to monitor the price behavior of the pair until we get a clearer signal, to be in front of one of the following scenarios:

Confirmation of the break of 1.0945/1.0940, a 23.60% Fibonacci retracement, leading the Euro to a bearish path, with targets starting at 1.0890 initially, while the price consolidated again above the pivotal resistance 1.1000. From here, the pair begins to recover, to visit 1.1040 and 1.1080, respectively, as initial targets.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations