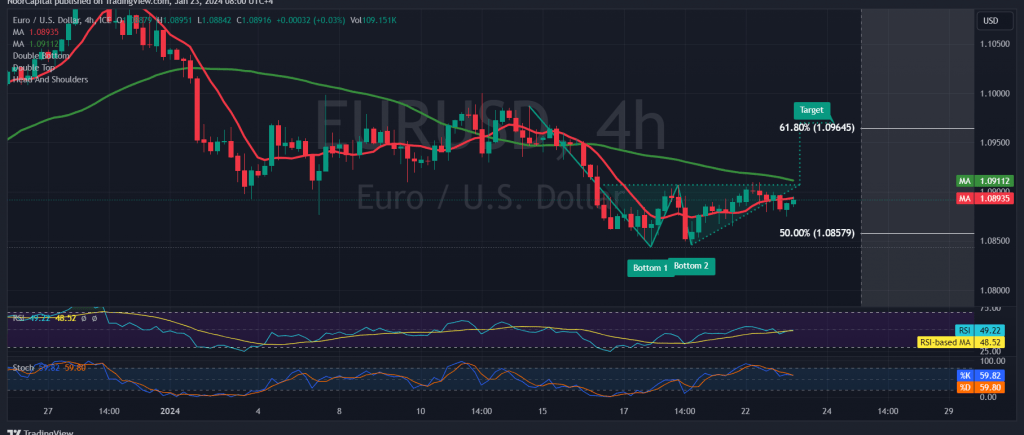

The EUR/USD pair experienced subdued trading in the initial sessions of the past week without notable changes. From a technical perspective, examining the 4-hour time frame chart reveals the euro’s attempt to establish stability above the 1.0890 resistance level. Concurrently, the Stochastic indicator is showing efforts to gain additional momentum that could potentially drive the price higher. However, the presence of the 50-day simple moving average poses an obstacle, limiting the resumption of the rally.

While there is a leaning towards positivity due to the emergence of a bullish technical structure, confirmation would be preferred through a breach of the 1.0910 level. This breach would activate the positive effect of the pattern, with an initial target set at 1.0960.

Given the conflicting nature of technical signals and the confined trading within crucial corrections, it is advisable to monitor the price behavior to assess one of the following scenarios:

- Uptrend Confirmation: A clear and robust breach of the 1.0960 resistance level, representing the 61.80% Fibonacci retracement, would enhance the likelihood of reaching 1.1000 and subsequently 1.1040.

- Downtrend Confirmation: The resumption of the downward path would be confirmed by breaking the 1.0860 support level, which corresponds to the 50.0% Fibonacci correction. This would facilitate a move towards 1.0800 and then 1.0760, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations