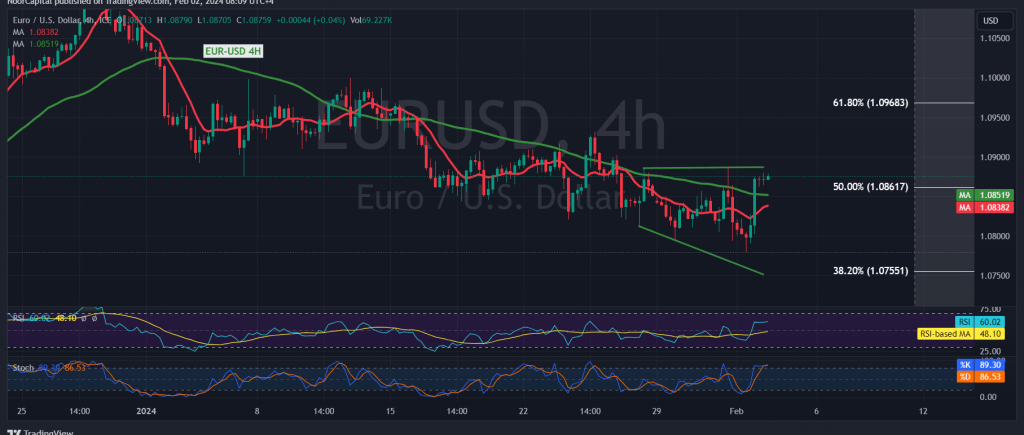

The euro exhibited positive momentum against the US dollar, driven by the proximity to a robust support level at 1.0770, marked by the 38.20% Fibonacci retracement.

Examining the 4-hour time frame chart from a technical standpoint, the mentioned support level prompted a retest of the formidable resistance at 1.0875, coinciding with the 50.0% Fibonacci retracement. A closer analysis reveals the significant role played by the simple moving averages, which have risen from below, signaling potential upward movement. This is further supported by positive signals from the 14-day momentum indicator.

While maintaining a positive stance, cautious optimism is advised, particularly if daily trading remains above 1.0810. A decisive breach of the 1.0875 resistance level is crucial to affirming the bullish sentiment, paving the way for potential gains starting at 1.0910 and extending to 1.0960, representing the 61.80% correction.

It is essential to note that a dip below 1.0810 reintroduces negative pressure, with downside targets around 1.0765 and 1.0740, potentially extending further to 1.0710.

A noteworthy cautionary point is highlighted regarding the release of high-impact economic data on the American economy, specifically the NFP, average wages, and unemployment rate” today. Expectations of heightened price fluctuations are advised during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations